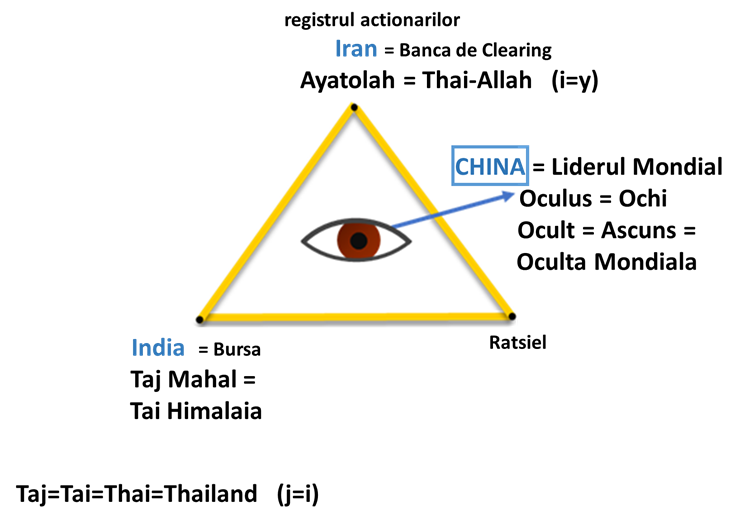

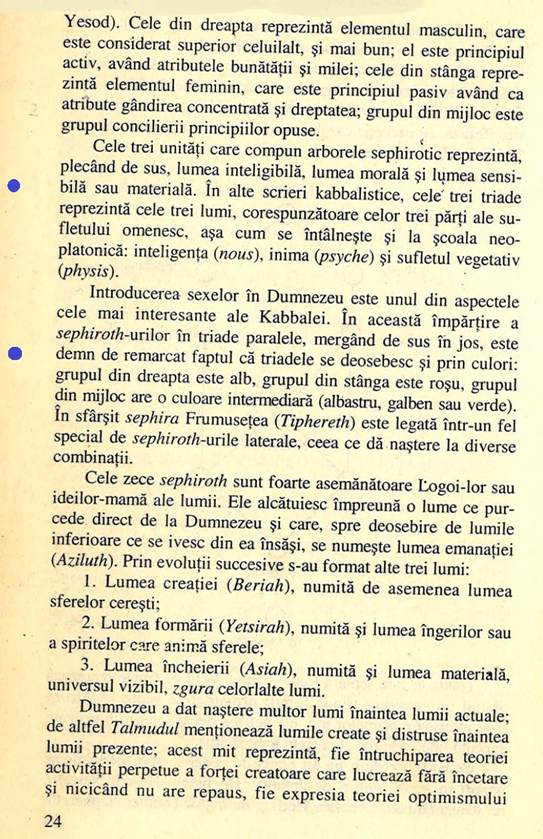

How elections for administration councils of all the multinational corporations of the world are organized by Tibet-China

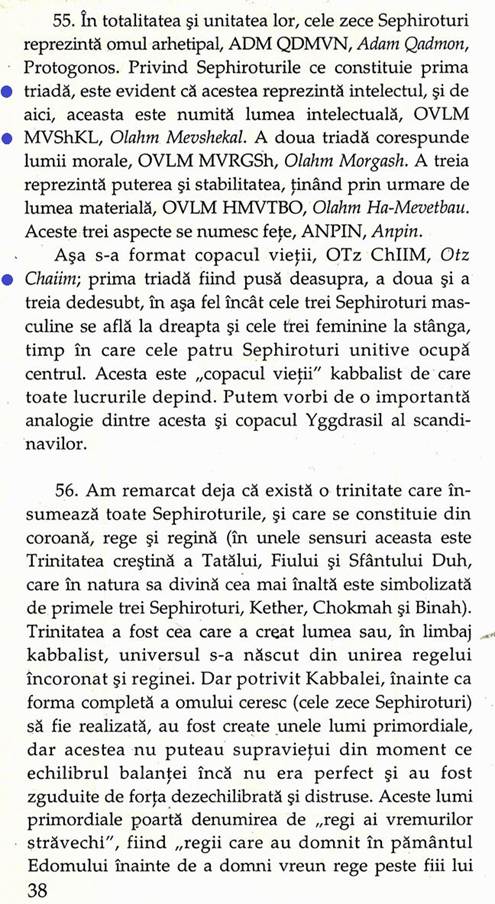

How to build a monopole

- The tools to build the majority of votes

a) Shares

Preference shares: provide a higher return based on a priority dividend that is paid before the dividends on ordinary shares; but have no voting right.

Ordinary shares: they do not have priority profit or dividend, but have voting rights.

Voting right shares: – are issued with the privilege of having one vote, two or more votes for a single share.

Participating preference shares: redeemable shares – where the investor can add a redemption clause if the dividend rate is known to fall in the not-too-distant future.

Cumulative shares: dividends accumulate over a period of several years. The dividend due is cumulated in all years in which losses have been incurred and will be tested first in the first year in which a profit is made.

Convertible preference shares: allows holders of preference shares to convert them into ordinary shares (with voting rights). Convertibility is expressed by the conversion rate. It depends on how many ordinary shares can be obtained for each preference share. If the conversion ratio is 2 to 1, then each preference share can be converted into 2 ordinary shares.

Treasury stocks: these are own shares that the issuing company repurchases from the market for various reasons. As long as they are in the treasury, the shares do not carry dividends.

b) Convertible bonds

Loans (or debts) convertible into shares – loan bonds convertible into shares. The holder of the bond is entitled to receive shares in the company in lieu of the money the company borrowed.

Bonds with warrants – these securities give the holder the right to subsequently acquire shares in the issuing company at a fixed price.

Index-linked bonds: the issuer assumes the obligation to update the value of these securities in relation to an index (this can also be a stock market index).

Preferential subscription rights – in case of a capital increase through the issue of new shares. The newly issued shares will be offered for subscription in the first instance to shareholders who hold pre-emption rights.

Subscription rights –equity warrant – consist in the participation of all holders of ordinary shares in the share capital increase by incorporation of reserves. So, the increase of the capital generates a free distribution of shares. In addition, the dividend may be distributed in the form of shares. The subscription rights can be sold on the market.

Warrant – is a security which entitles the holder to buy shares in the issuing company at a price fixed by the warrant. On the market they appear as:

– warrant shares;

– warrant-linked bonds.

All these loan bonds allow the money lent to a company to be converted into voting shares in that company. These Bonds and Rights that convert into shares are sold on the stock exchange. Thus, they can be bought by the shareholders of a company before the General Meeting of Shareholders in order to have a large number of voting shares.

That’s how you build a majority of votes to appoint the company’s first director.

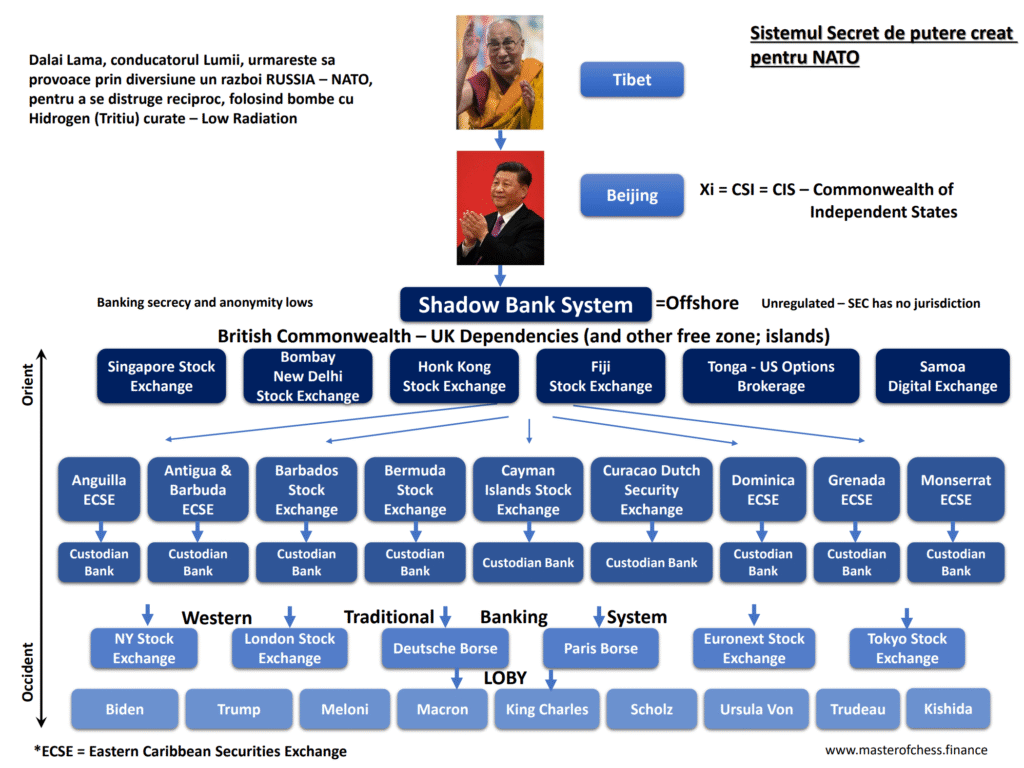

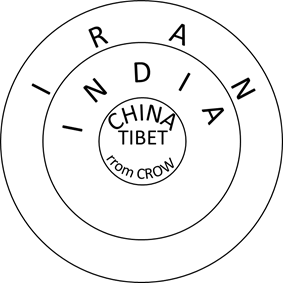

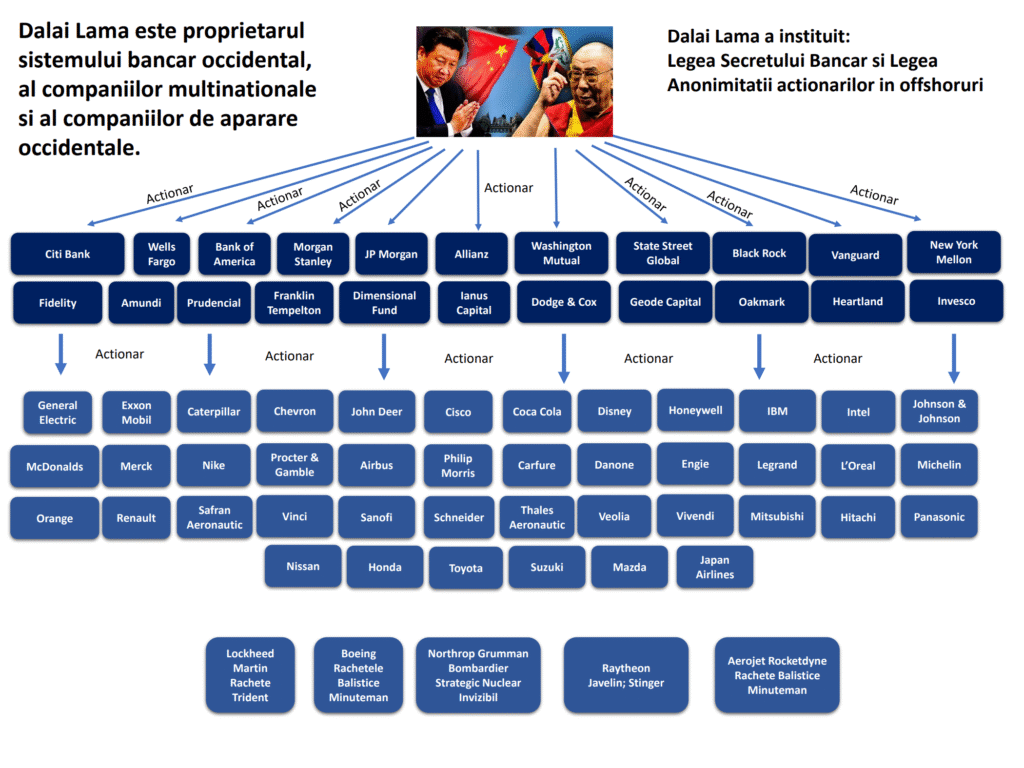

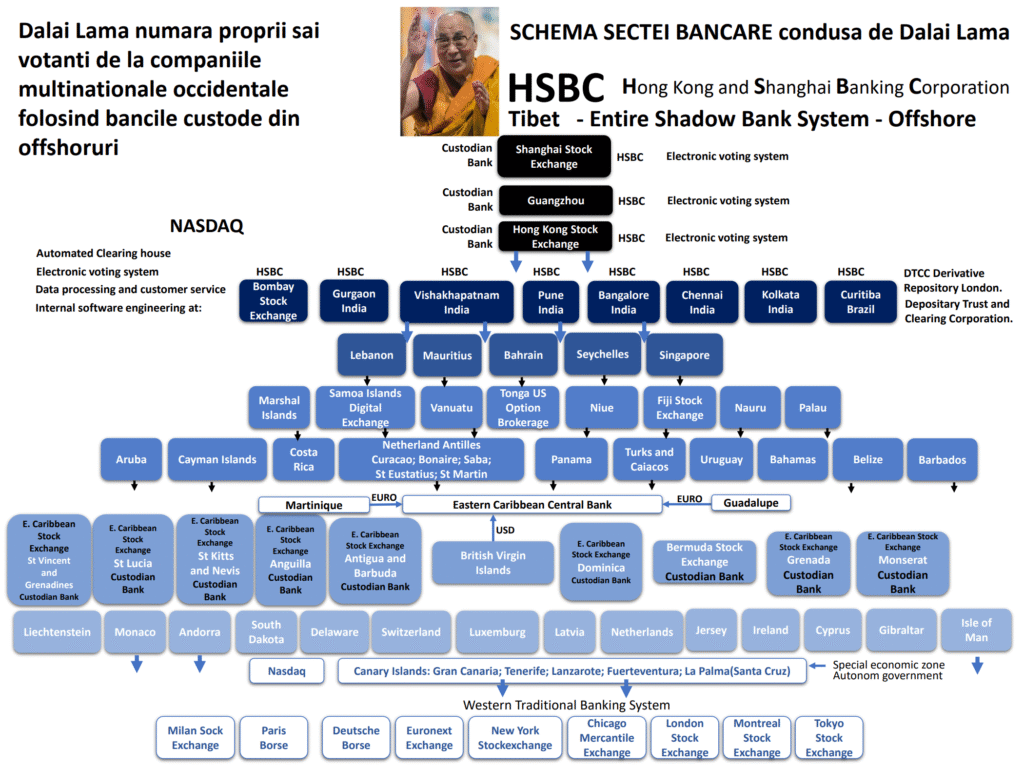

These types of shares and bonds convertible into shares were invented and legislated by the “Tibetan Banking Sect” led by Dalai Lama to control by a majority of shareholders (voting shareholders) all the companies and multinational corporations registered in the West.

Attention!!! – these companies are only registered on American and European Territories, but their owners, their masters, are in Tibet – China.

We have seen some of the tools used to build a voting majority. Now let’s see how the voting proceedings are, because you cannot get 100 Chinese into the voting room:

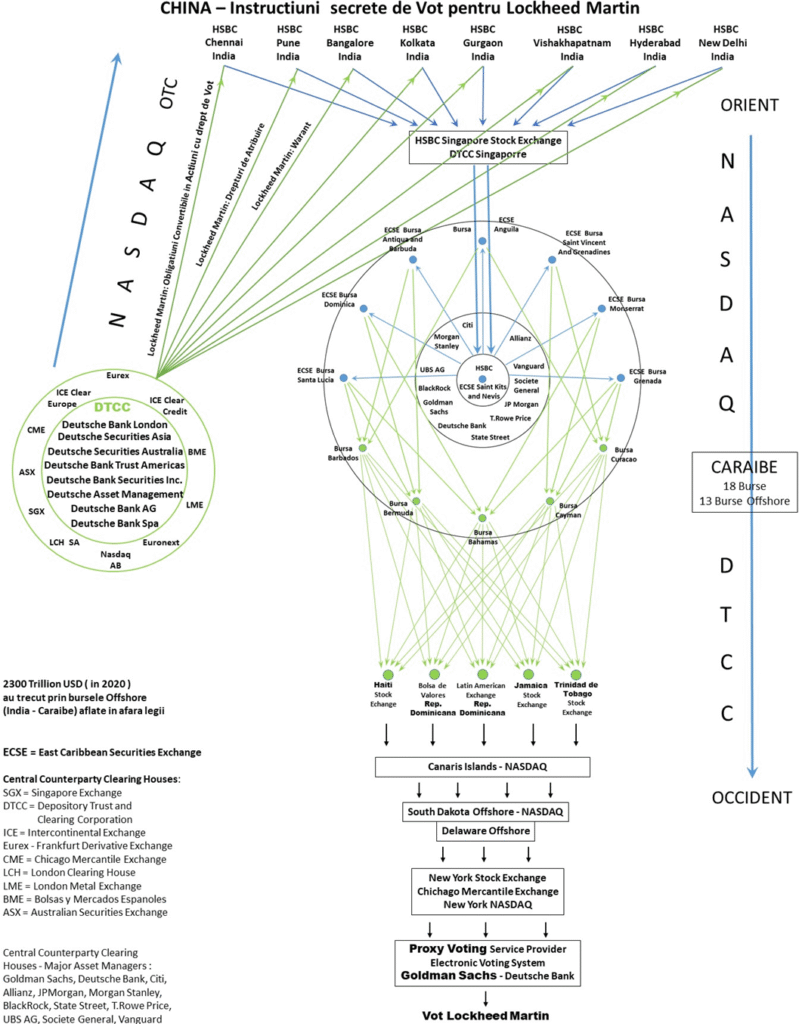

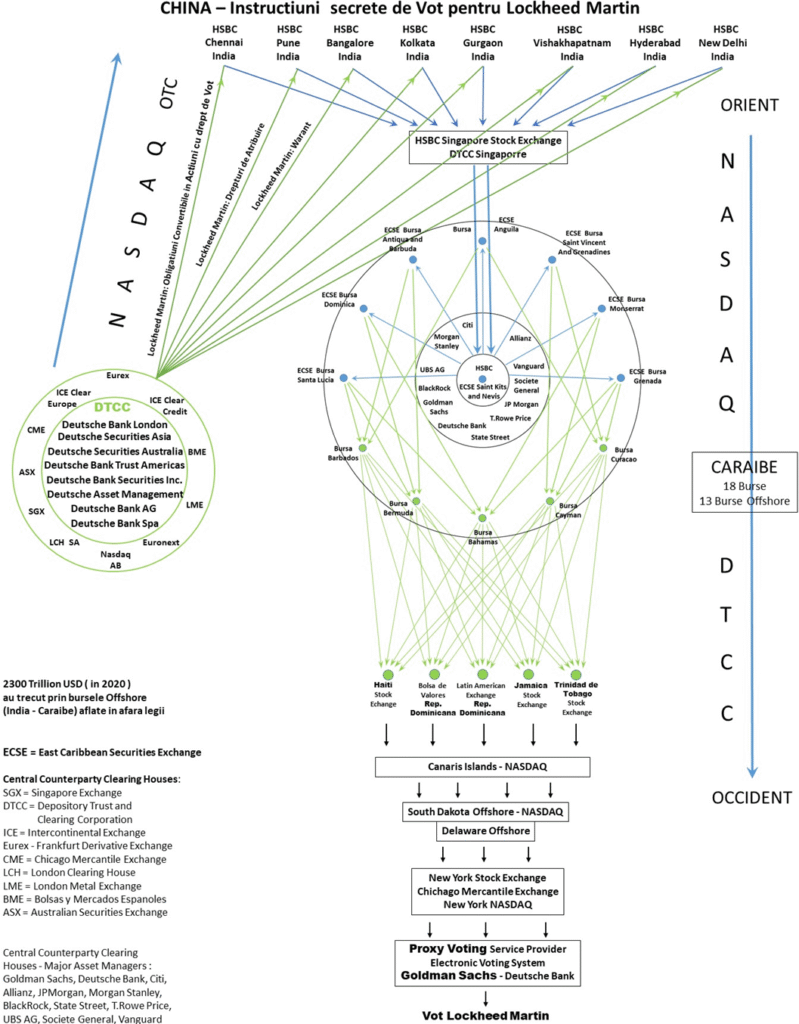

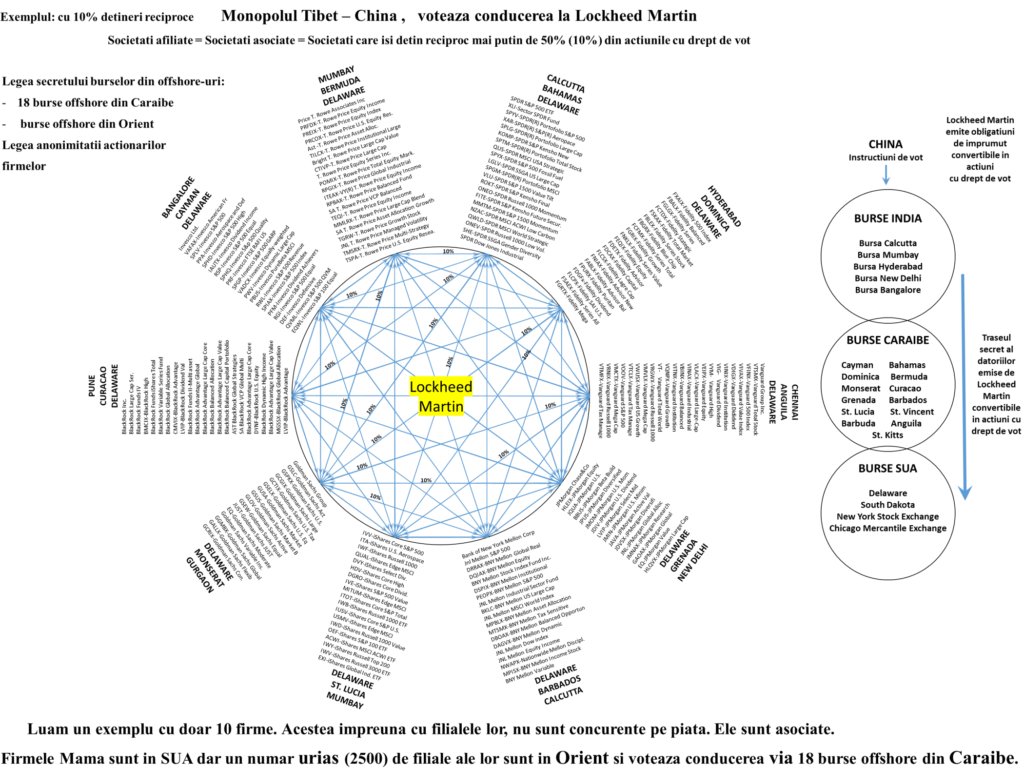

Thus, Chinese voters give voting mandates to secret agents in the Indian Punjab to vote in their absence. This secret agent presents himself as a representative of the company that owns the shares. This firm is part of the Tibetan Banking Trust. At his turn, he represents an institution to represent him in the General Meeting of Shareholders – a closed corporation in Gurgaon, Hyderabad, Pune, Kolkata etc from India, Singapore.

This company, in its turn, mandates another institution – Custodian Bank and it is precisely that bank which aims to hold listed shares in custody, and therefore of his company, too.

Custodian Bank, which is based in Singapore, has full access and visibility to the shares and convertible bonds held by all the companies which trade on that exchange. It is linked to a stock exchange and keeps track of the stocks and bonds and the futures contracts that are backed by stocks (convertible into shares) held by those who buy or sell on that exchange.

Example

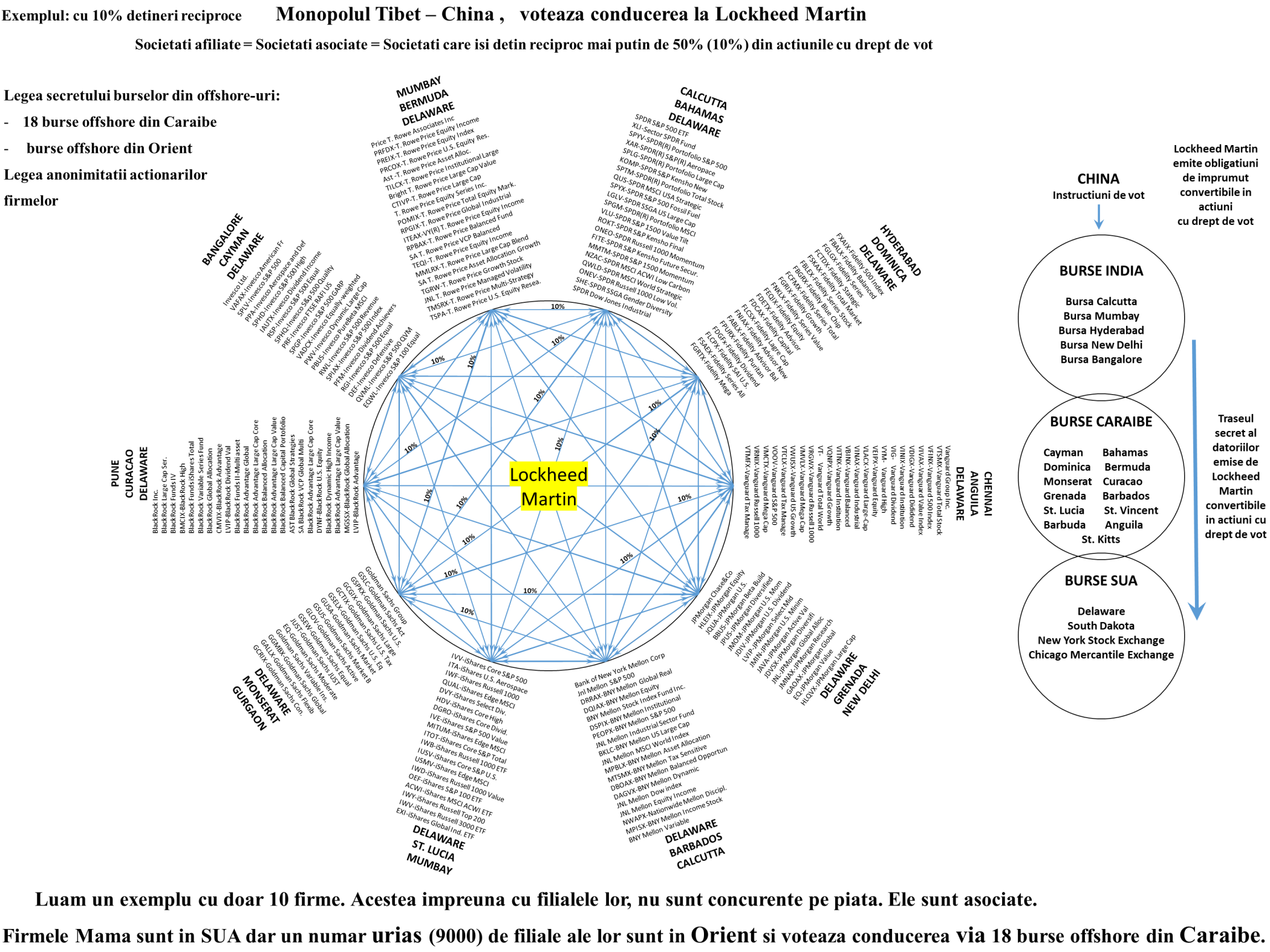

Suppose that on the St. Lucia Securities Exchange in the Caribbean, baskets of assets (option contracts), exchangeable into shares, have been bought on the Boeing firm by a buyer – JP Morgan’s mutual fund – from a seller in Singapore. Then the baskets (packs) of financial assets convertible into Boeing shares are transferred from the Singapore Custodian bank servicing the Singapore stock exchange to the Custodian bank in St. Lucia in the Caribbean.

Let’s assume that other baskets of options contracts that can be converted into Boeing shares have also been bought by a firm – Vanguard, for example, on the Grenada (Grenada Securities Exchange), also in the Caribbean, from a dealer in Singapore. In this case, too, the basket of futures contracts with options from the Singapore Custodian Bank, attached to the Singapore Stock Exchange, are transferred into custody in the Grenada (Caribbean) Custodian Bank, attached to Grenada Stock Exchange, called the Eastern Caribbean Securities Exchange (ECSE).

Further, let’s presume that other baskets of strategies and options based on convertible bonds from Boeing company have been purchased by a dealer, such as Black Rock, on the Dominica Stock Exchange, called Dominica Eastern Caribbean Securities Exchange, from a dealer, let’s say Goldman Sachs, also from Singapore.

Then, these option strategies packs, based on convertible bonds, warrants and “attribution rights” of newly issued Boeing shares are transferred from the Singapore Custodian Bank servicing the Singapore Stock Exchange to the Dominica Custodian Bank attached to the Dominica Stock Exchange.

In reality, these packs of financial products are made in India and pass through Singapore, then on through the Caribbean Stock Exchanges (18 stock exchanges) which are the link between the East = India and the West = USA, Europe, Canada. Subsequently, the packages of bonds convertible into Boeing shares are in the possession of the 8 Custodian Banks from the Eastern Caribbean Securities Exchange (LCSE), distributed as evenly as possible, they are waiting for the deadline, so all the OTC derivatives that are backed by bonds convertible into Boeing Company shares of to convert into shares of The Boeing Company.

In the futures and futures with options contracts that are backed by bonds convertible into shares, warrants, “rights” issued by Boeing – mentioned at the beginning, there is a trigger point at which they no longer bring the expected profit and under this artificial pretext they convert into shares of Boeing.

Dealers/sellers and dealers/buyers on Indian stock exchanges intentionally place buy and sell orders that intentionally drive financial products through that “market” value called the trigger point. In this very subtle maneuver, the stock exchange broker also participates, together with the dealers and they all drive the financial assets to the trigger point and thus they change into shares (and the profit from the dividend of the share becomes more attractive than the profit from the bond interest).

We mention that at the time of the triggering of the share subscription, those financial products are no longer in the Custodian Banks in India and Singapore and in the Offshoring Bureaus in the Caribbean, but they are already in the Electronic Stock Exchanges in the Canary Islands and in the offshoring bureaus in Delaware and South Dakota, and further on in the New York Stock Exchange, New York NASDAQ, Chicago Mercantile Exchange.

These Stock Exchenges in the Caribbeans are:

– Montserat

– Anguilla

– Saint Lucia

– Grenada

– Dominica

– Saint Kitts and Nevis

– Saint Vincent and Grenadines

– Antigua and Barbuda

And they form the group of the 8 Eastern Caribbean Securities Exchange (ECSE),

Attention!! – bonds convertible into shares are held in custody at the Custodian Bank serving the Stock Exchange where these were bought last time.

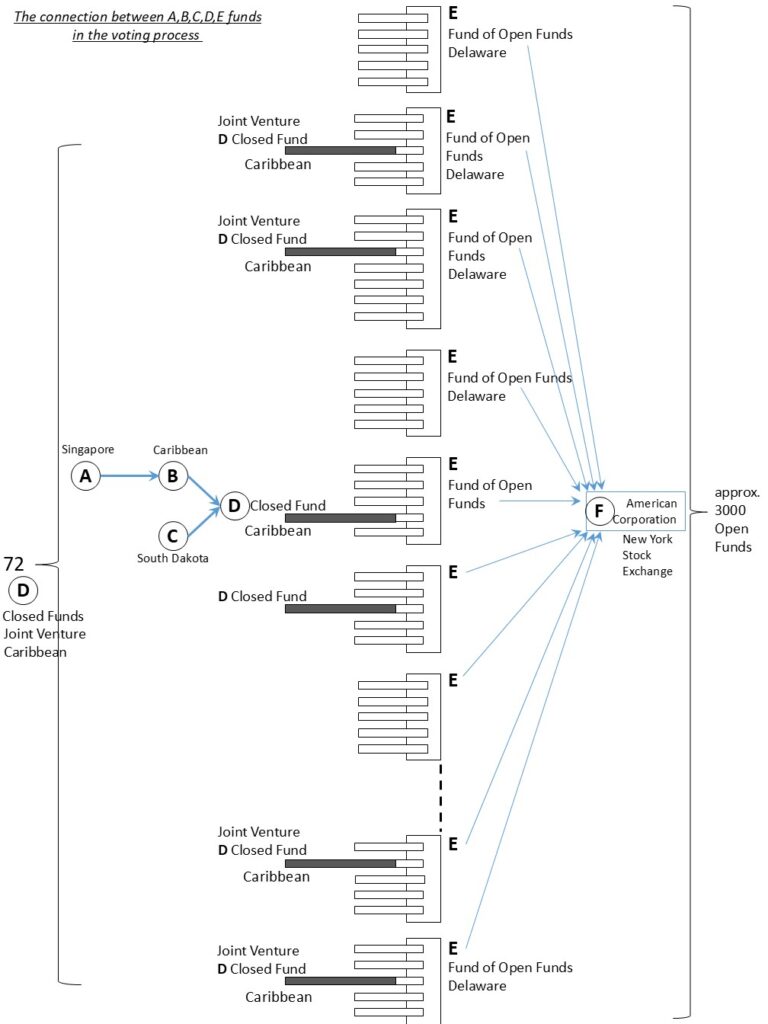

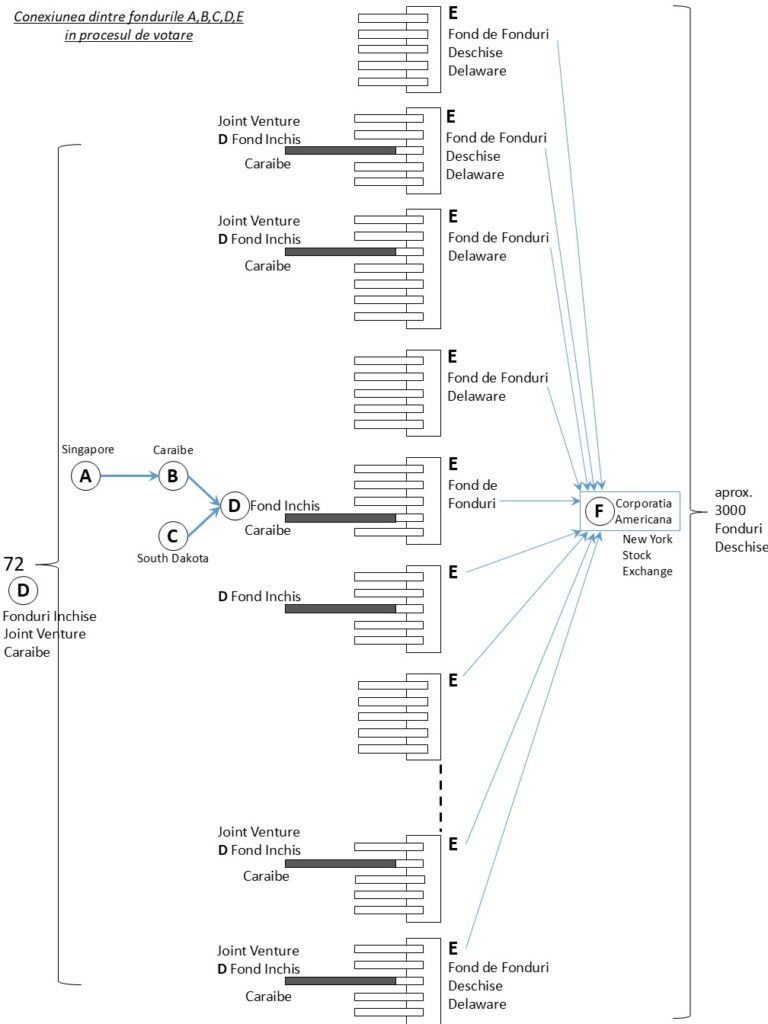

After this phase, the financial architects from China/ Tibet prepare the asset bundles (baskets of financial assets) to be converted into shares and they prepare the 72 (100) companies out of 2500 companies (forming the Tibetan Banking Trust) which are the most suitable to take possession of these assets (to use them for voting).

Attention! – The 72 companies that accumulate shares for voting are designated in turn from the 2500 financial companies which form the Chinese Secret Trust.

These 72 financial companies will always be different, that appoint the management of every Multinational Industrial Corporation using the following indices: S&P 500 and Dow Jones.

These 72 companies, all with percentages below 1% will have a voting power of 37% – 40%, enough to appoint the management.

In order to collect shares, there will be created bundles or baskets with assets that can be converted into shares.

These baskets contain:

– bonds convertible into shares;

– bonds with warrants convertible into shares;

– bonds with subscription warrants (which allow you to subscribe for newly issued shares);

China has chosen the Indian stock exchanges to be at the top of the chain of merged exchanges (from Europe, the US and Canada).

NASDAQ is an exchange of the world’s stock exchanges and because it sits at the top of the pyramid of merged stock exchanges, it is able to see all types of stocks and bonds, to see who is their owner, to create the package of assets and bring them to the trigger point. At this trigger point, the bundles of assets are converted into shares.

As well as the DTCC – Depository Trust and Clearing Corporation which is the largest conglomerate of interconnected custodian banks and has the right and ability to see all the stocks and bonds, who owns them and how to drill down the basket of assets that can be converted into shares. These OTC assets, based on bonds convertible into shares are traded on the Caribbean Stock Exchanges and end up in the Caribbean Custodian Banks. The, they are sold, in portions, to:

1. Stock Exchange in the Trinidad and Tobago.

2. Stock Exchange – Latin America International Financial Exchange in the Dominican Republic.

3. Bolsa de Valores de la Republica Dominicana.

4. Haiti Stock Exchange.

5. Jamaica Stock Exchange.

And, finally, they end up at the Custodian Bank of these stock exchanges.

It is very important to mention that these five stock exchanges are not offshores and, thus, they do not arise suspicions.

After which they are sold to the stock exchanges in the Canary Islands, which are independent of the Madrid government (There is a talk of a possibility that they are not offshore, but, in reality, they function as offshores on the NASDAQ market).

This is where convertible bonds go (through transactions between several mutual funds – mixed trading), through empowering an agent for the following US offshores:

1 – Delaware – a financial giant, home to thousands of mutual funds;

2 – South Dakota – a disguised OTC commodity exchange. Sales are made through the Electronic Communication Network on the NASDAQ market.

In these exchanges, the Custodian Bank (Proxy Voting Service Provider) is responsible for executing the voting process and secures the majority of votes to appoint the board of directors and the chief executive officer (CEO).

II. Ways to get the majority of votes

In order to prepare a majority of the votes in the possession of the financial companies that form the Tibetan Banking Trust, their financial experts use several methods.

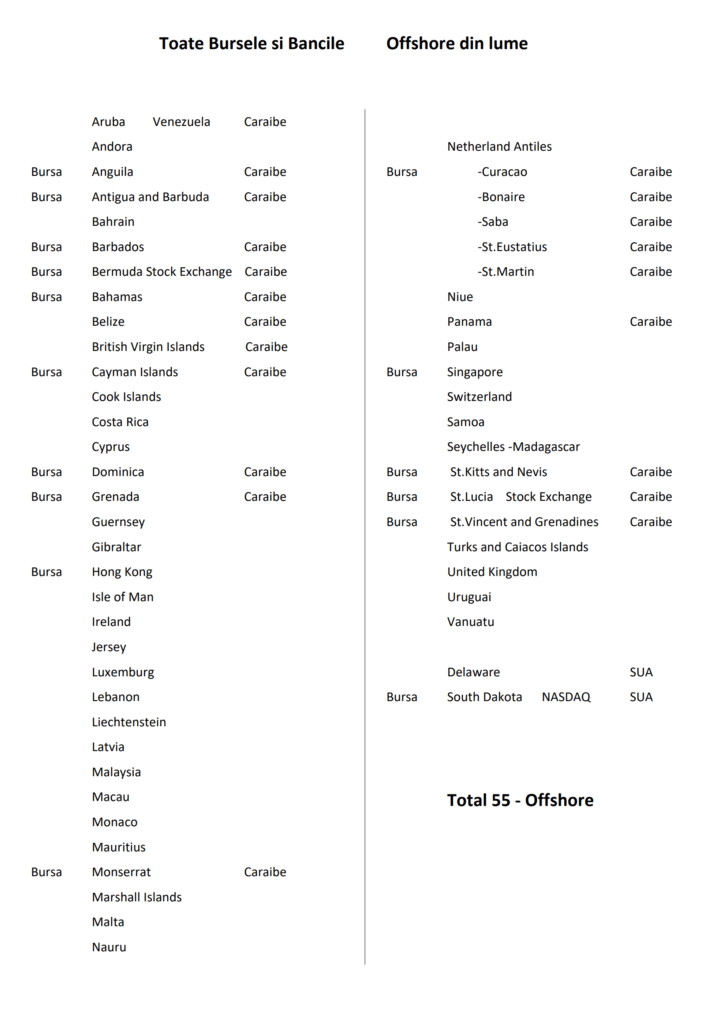

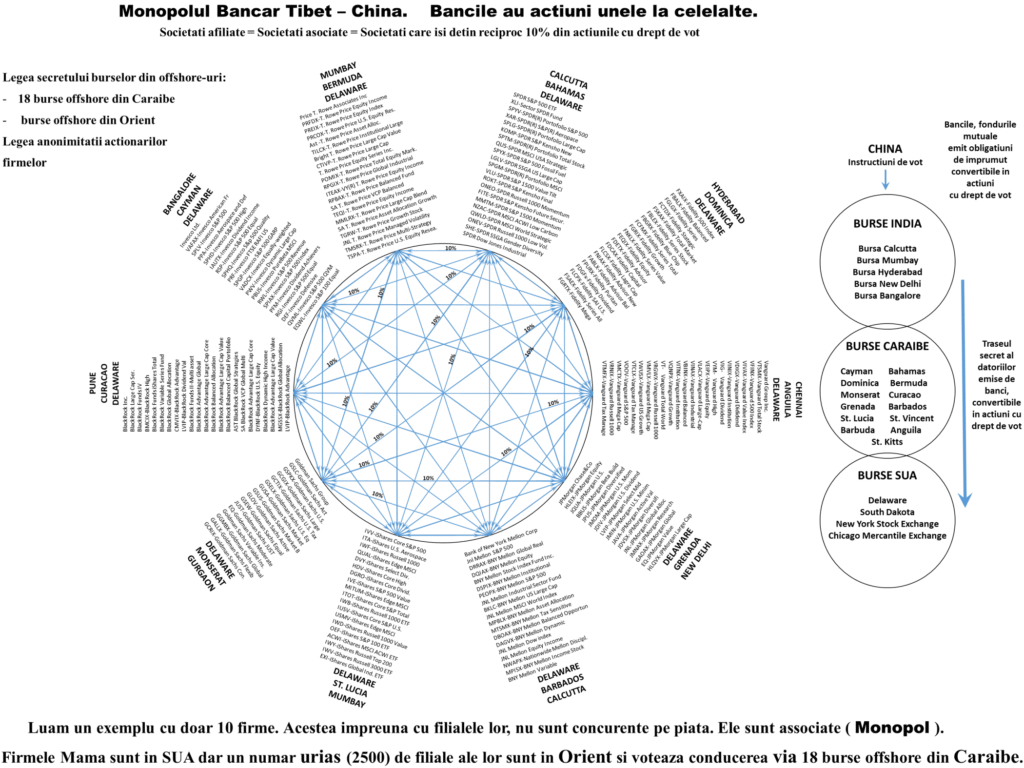

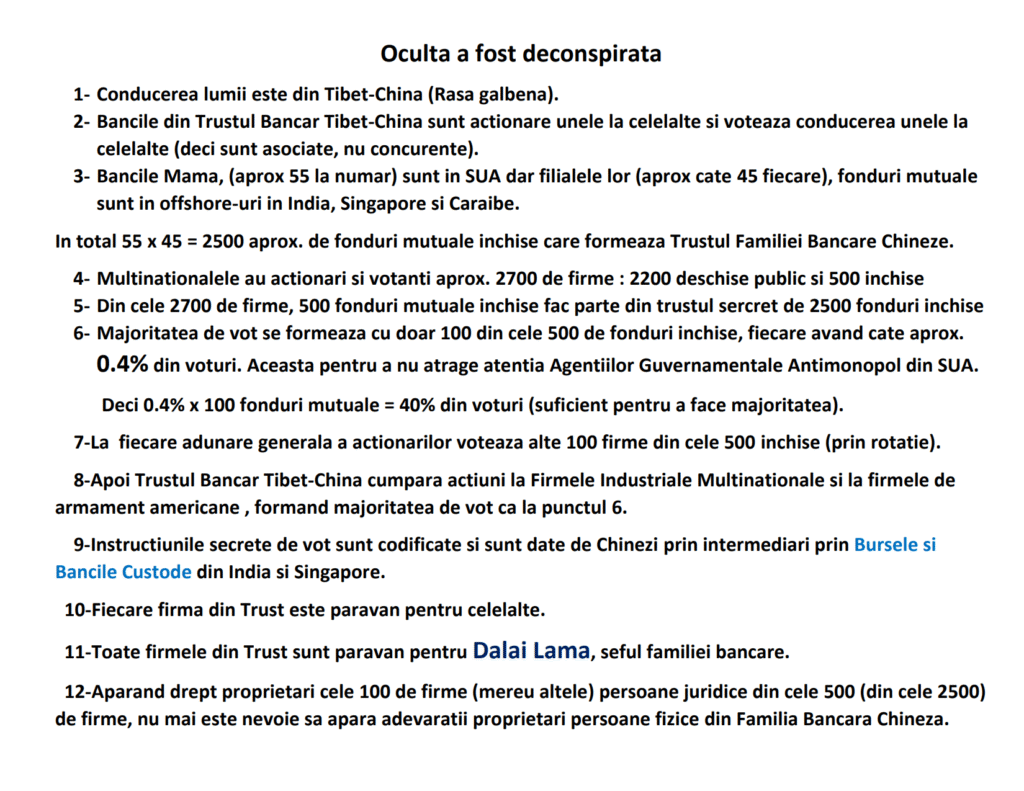

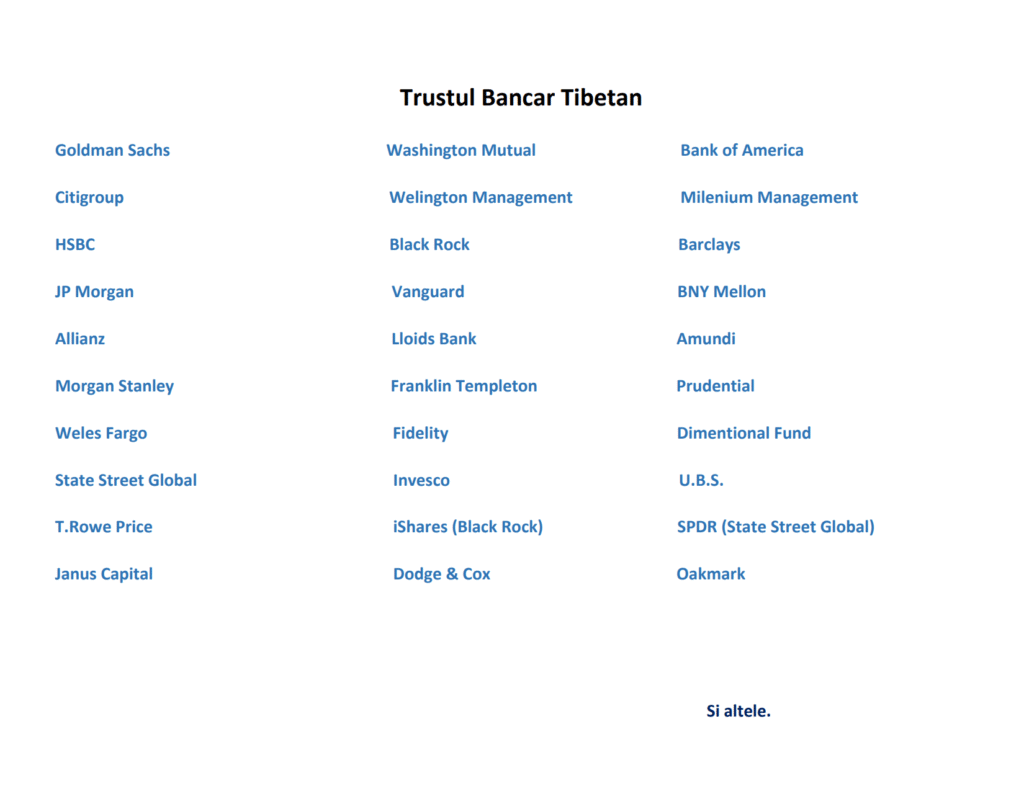

Let’s assume that the number of parent companies in the Tibetan Banking Trust is of approximately 55. Each company has about 45 “offspring” – subsidiaries – other companies in the same group that have the name of the parent company: commercial bank; investment bank; mutual funds; hedge funds (venture capital funds); broker dealers (i.e. stock exchanges); insurance firms; asset manager – i.e. custodian bank or clearing bank; closed corporation. A total of 55×45=2500 companies (approximately).

Out of these companies, the Chinese financial architects have to choose 72 companies that hold a majority of 37-40% from company’s voting rights in order to vote at the General Assembly of Shareholders and elect a director. The director has to be of Jewish origin to falsely claim that Jews run all the world’s companies and finances (which is completely false).

It should be mentioned that 10-20% of the issued shares do not have voting rights.

Also, companies that have large shareholdings of 2% – 3% of the shares do not have voting rights because international financial laws do not allow this. This is because the very object of their business is to own shares in other companies for the purpose of trading shares. Thus, it is assumed that they would be tempted to monopolize the market.

This is just a front for government agencies to focus their vigilance on the big shareholders.

While anti-trust agencies in the West keep an eye on the top shareholders, the Chinese are secretly scrutinizing a voting majority with many small shareholders holding less than 1% of the votes. They do not attract any attention, but they vote, in an organized way, the same candidate for the CEO – director position, based on a secret code.

72 shareholders x 0.51%= 37%

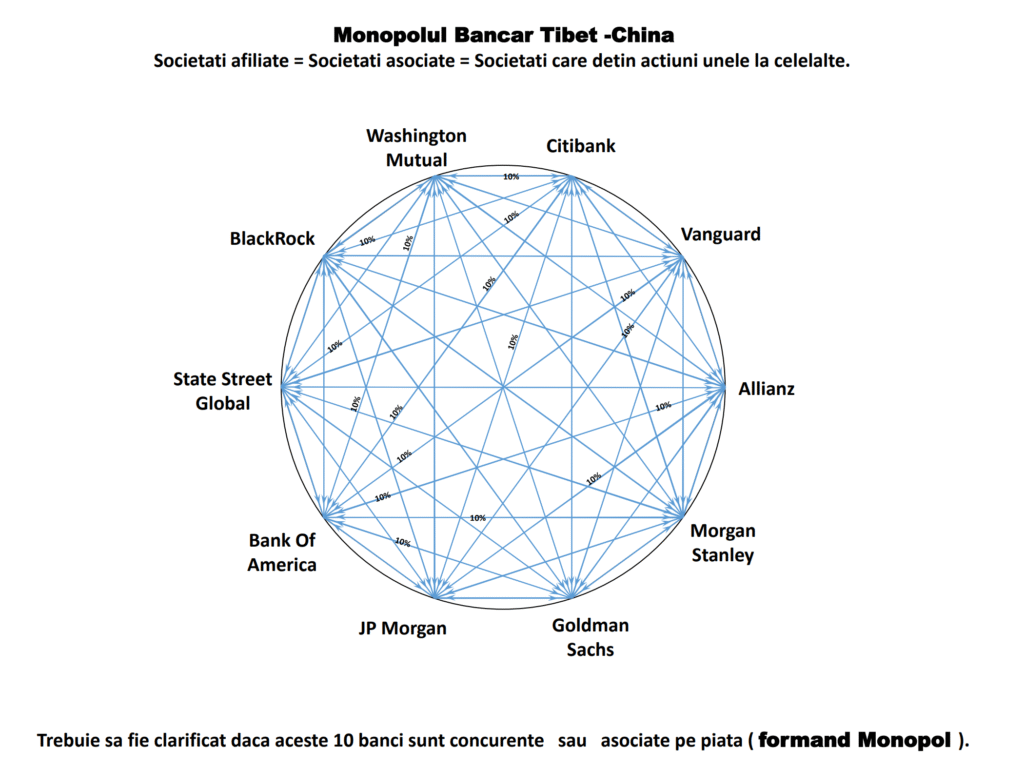

So with an average percentage of 0.51%, you can get 37% if all the 72 members vote the same members in the Administration Council. This assumes that out of 100% shares only 80% have voting rights. Thus, the 2500 companies, by buying shares from each other, and by inholding a majority of votes from each other, have practically merged.

Legally, the additional merger of two companies happens quite differently, it is highly visible, debated in the media and it is publicly announced. Two companies can merge by exchanging shares or by issuing new shares to the new merged company, so that the value of a shareholder’s shares is equivalent to the value of that shareholder’s shares before the merger.

In the case of the trust of 2500 Tibetan financial companies, their merger is not publicized because they merged secretly on the stock exchange. They tacitly agreed to buy each other’s shares, to vote for each other and to appoint each other’s administration boards. Now, they are forming a single company, in fact a conglomerate formed by the invisible merger of 2500 financial companies. After the monopoly of these 2500 financial companies was formed, it votes on American industrial companies by rotation. This merger goes unnoticed by Western democratic society or anti-monopoly government agencies. No one can imagine the mechanism through which 2500 companies might be colluding to vote for the same candidate for CEO.

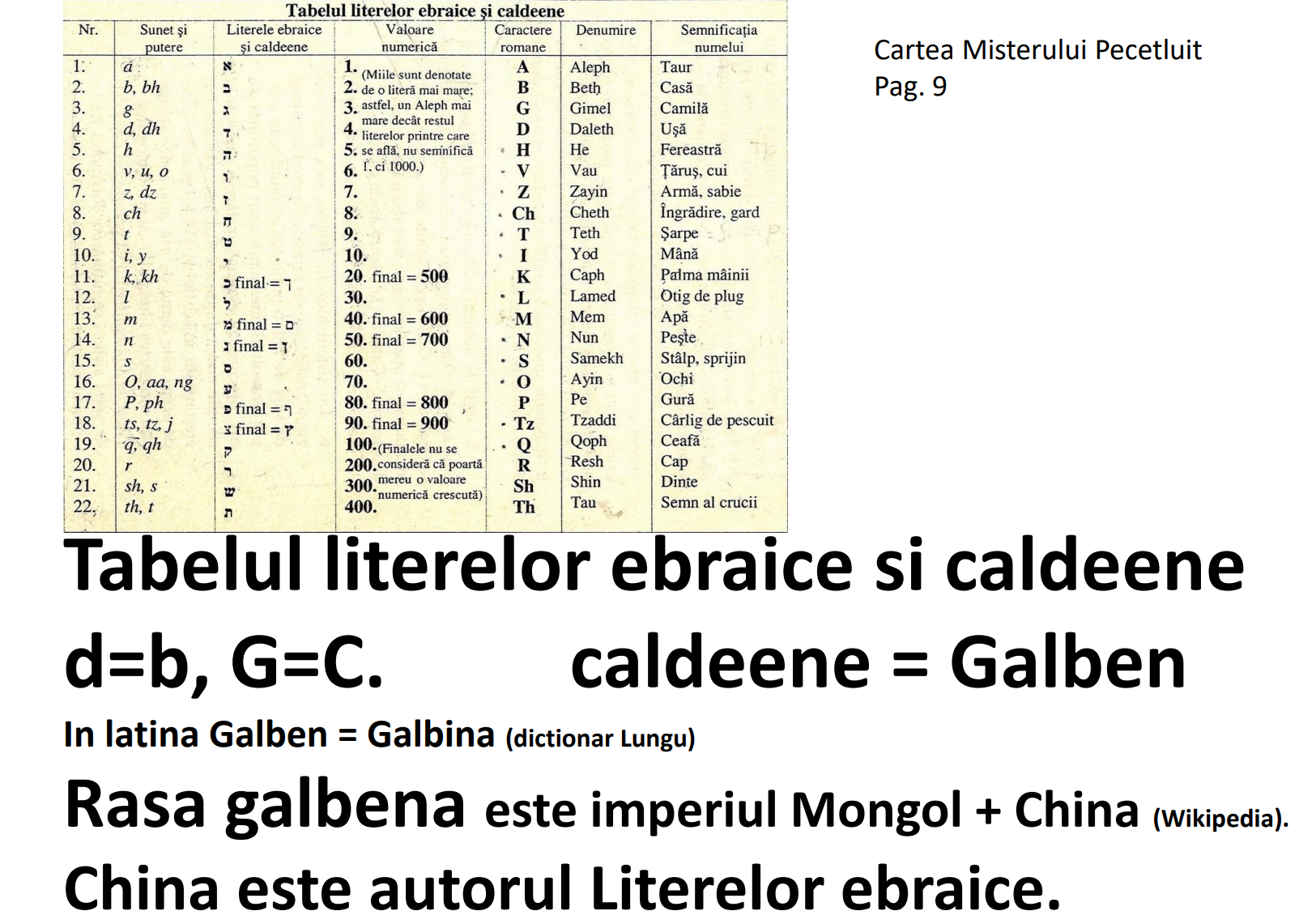

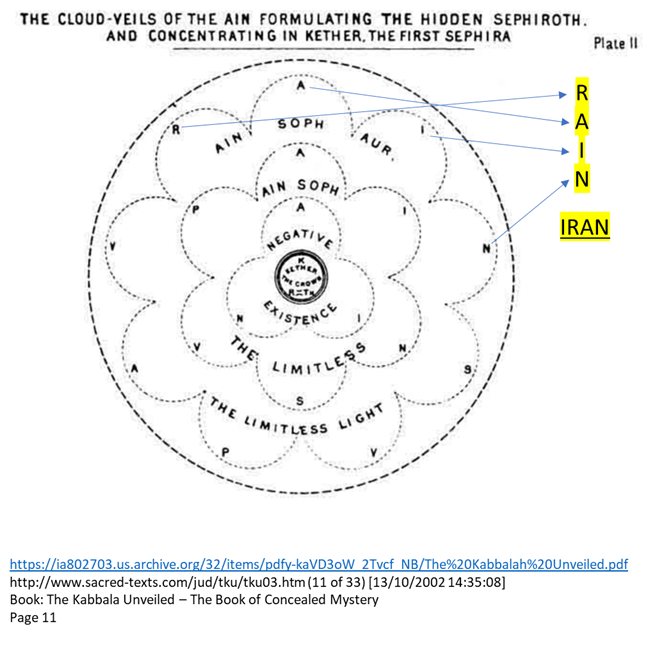

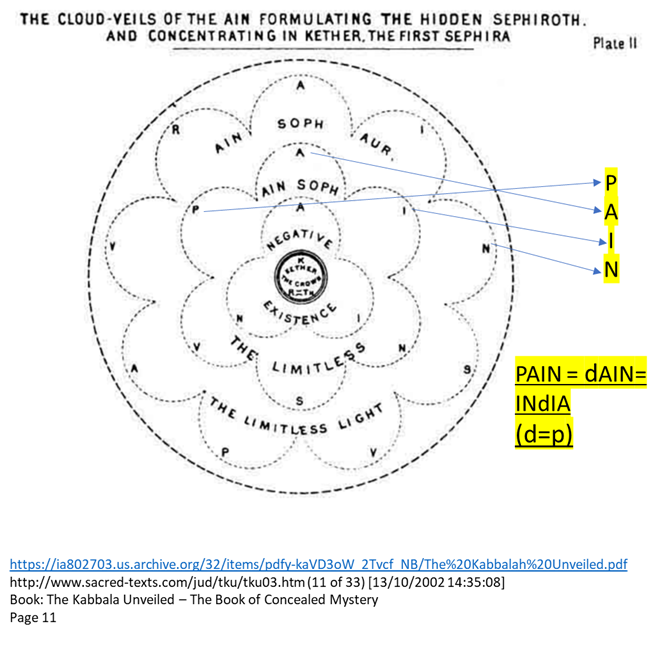

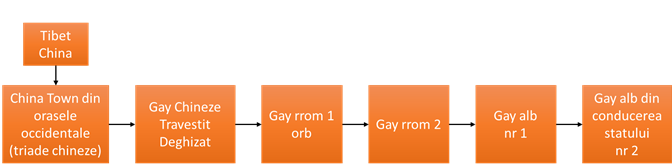

This illegal merger is being conducted from Tibet since old times, very precisely, on the basis of some password and on ciphering tables, named polyalphabetical ciphers. The tables are very well explained in Kabala – Ceremonial Magic (page 109).

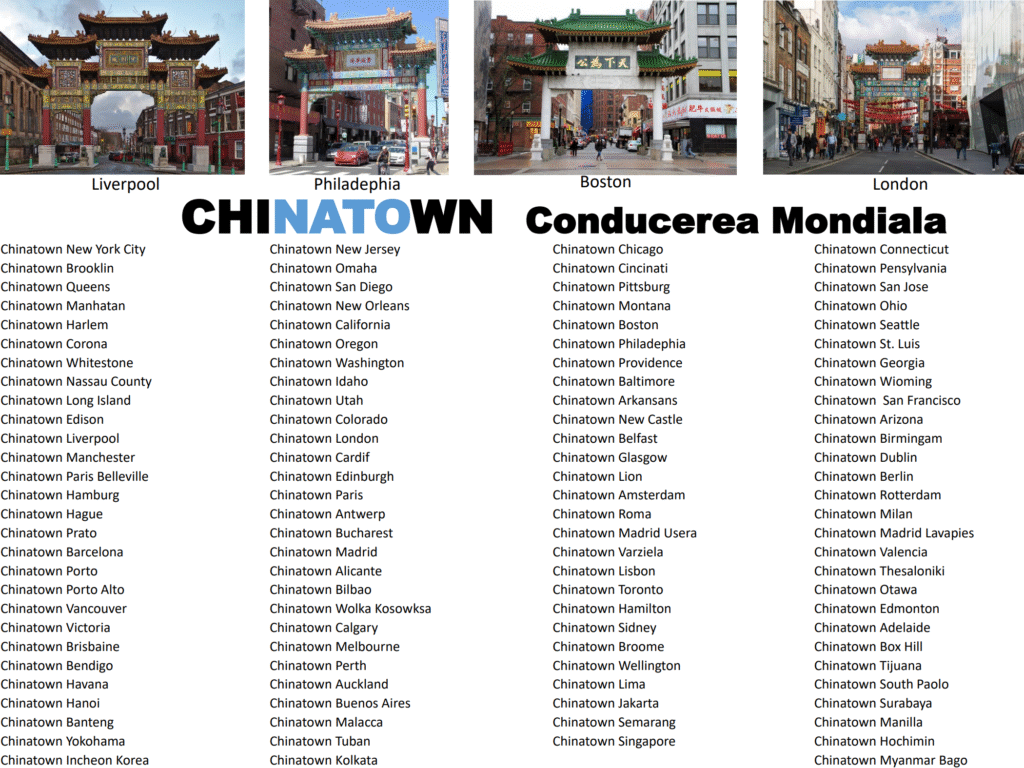

Passwords are transmitted directly from CHINA TOWN, from the American towns where there are stock exchanges, through the intermediary of Roma agents to the Indians who control the stock exchanges and to the Iranians who control the Custodian Banks.

Neither the Iranians nor the Indians know that the ciphers come from Tibet through China Town, to be spread throughout the whole West. Moreover, neither the Iranian nor Indian governments know that they are participating in the activities of a Chinese banking sect.

Only a small group of 500 – 1000 Iranians led by the Ayatollah and a small group of 500 – 1000 Indians led by the religious leaders of India (from the Taj Mahal area) and the Brahmins are involved in this occult banking activity.

The secret voting authorization contains:

a) the name of the financial company which holds the shares, number of held shares and number of corresponding votes which it is entitled to express at the general meeting of shareholders;

b) the number of votes given to each of the 9 candidates, out of which 5 will be elected for the administration council.

Then, the 5 elected persons will choose the company manager, with a majority of votes.

The agent authorized to pass on the passwords and the name of the candidate to whom the votes will be allocated is protected by the law of anonymity and the bank secrecy law. He is part of a closed financial corporation – not open to the public (closed corporation) and it is an offshore.

Voting Scheme – Companies

There are six types of companies that come into play:

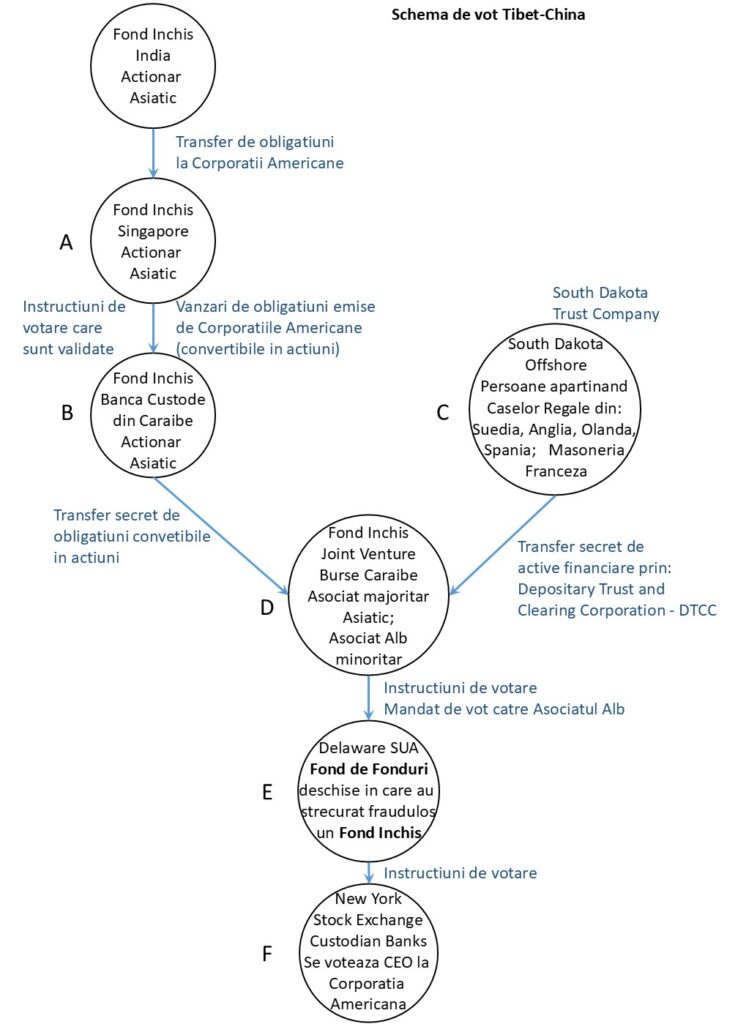

A. Oriental closed-end mutual funds having the head office in Singapore (but organized from India), owned by rromani (gipsy) dealers under China’s command.

B. Closed mutual funds, having a Caribbean head office, owned by other rromani dealers (Chinese agents).

C. Anonymous individuals man, members of – Royal family of Sweden

– Royal family of England

– Royal family of Holland

– Royal family of Spain

– high-ranking French Freemasons

Their secret financial accounts are base in South Dakota Offshore (South Dakota Trust Company). Their wealth (stocks and corporate bonds) are kept secret by Custodian Banks (part of the Depositary Trust and Clearing Corporation – DTCC ).

D. Closed joint ventures, formed with the participation of B and C funds.

E. American fund of open funds, based in Delaware USA. It is an open-end fund of funds owned by individuals and other open-end funds. D type funds is one of the E fund shareholders.

F. American company where elections are organized (elections are being frauded), banks, industrial corporations.

Each type of company is detailed below.

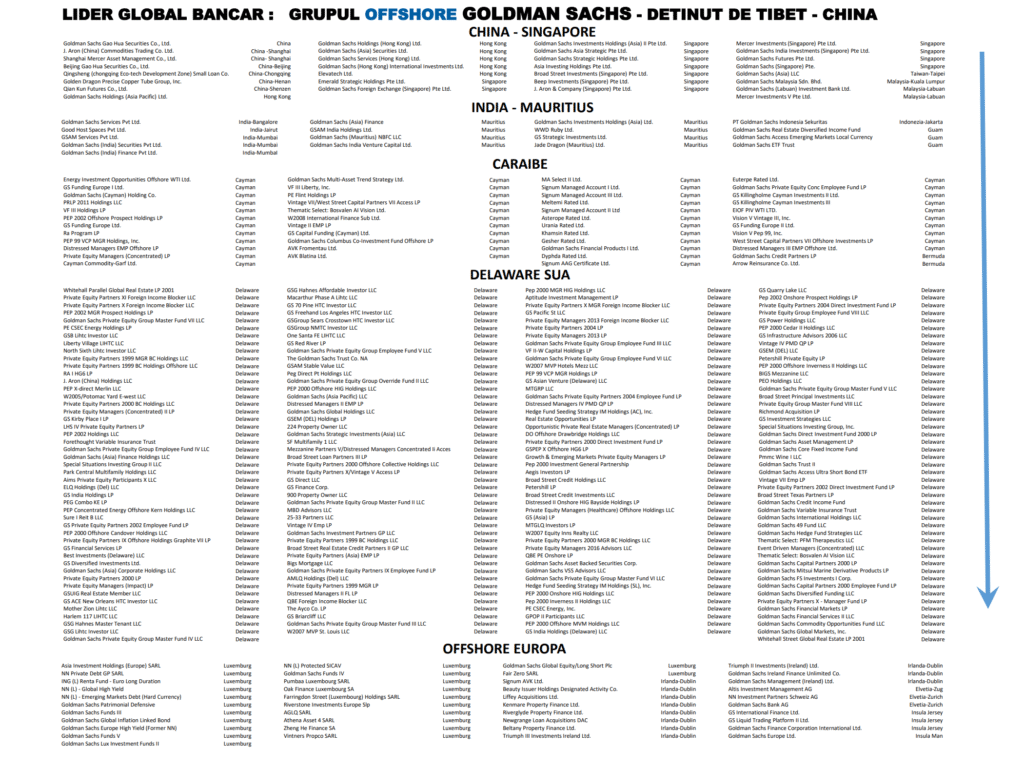

A. Singapore’s closed corporation funds are part of the secret Tibetan Banking Trust.

These closed-end funds cannot be held by the general public, so they are not open for public subscription, their shareholders are Rromani citizens, who are protected by the law of anonymity and they are under the control of Tibet-China.

They are not the ultimate owners of the working capital. This capital is owned by Chinese agents who have their companies (other closed-end funds) in offshores in India (Chennai, Pune, Bangalore, Kolkata, Gurgaon, Vishakhapatnam, Hyderabad, New Delhi).

These closed-end funds are designed to collect OTC derivatives pools of assets – options contracts backed by bonds convertible into shares in US corporations (banks and industry).

In addition to convertible bonds, there are other financial assets that form support for the options contracts:

–warrants

–subscription rights – equity warrants: give the owner the right to buy new convertible bonds and new shares

–preferential subscription rights – which can be converted into shares in the US companies where elections will be held for appointing CEO.

B . Closed mutual funds based (head office) in the Caribbean

They present themselves as subsidiaries of US financial companies only to confuse Western anti-trust agencies with their names.

In total there are approximately 2500 closed corporation funds based in India, Mauritius,

Singapore, Caribbean. Although they have the nationality of the country where they are having the head office, i.e. Indian, Singaporean or Caribbean, they have American names: JP Morgan, Goldman Sachs, Allianz, Morgan Stanley, State Street Global, Washington Mutual, Blackrock, Vanguard, Fidelity, Citigroup, Wells Fargo etc.

The parent banks that form the Tibet-China Banking Trust are approx. 55 (see table with Tibet – China Banking Trust) and they are based in USA so they have US nationality. But their so-called subsidiaries (children), closed-end mutual funds located in the Orient and Caribbean are about 45 for each parent (mother) company. These children (subsidiaries) have Oriental and Caribbean nationality.

In total, 55 x 45= 2500 approx. Eastern and Caribbean branches as previously mentioned.

These Oriental and Caribbean branches get to hold the majority of votes also in the US parent companies, through the scheme described here-in-below:

These 2500 closed corporations own shares to one another and vote the management of one to the other, creating a MONOPOLY.

Caribbean mutual funds are designed to set up joint ventures with C type funds, owned by white gay Mason American citizens from South Dakota. The wealth of white from South Dakota offshores is administrated by Custodian Banks from South Dakota. Practically, they will use white American citizens as a shield to fraud the voting process, letting the American public and political elites know that white man votes.

C The anonymous individual part of the Royal families of Sweden, England, Netherland, Spain and also high-ranking French Freemasons (generally white gays) based in South Dakota offshore USA have the role to mask the majority capital contribution of his associate Rromani people (who owns the closed fund B). Closed funds B and individuals C are associated in a joint ventures. At the same time, the white dealer also masks “Record date” vote, given by the A company in Singapore. This, for the American public and ruling white elites to believe (erroneously) that the voting instructions were given by the white associate. In reality the white man vote instructions were not taken into consideration (the white associate was empowered to vote by his gipsy associate using a voting Trust Certificate).

Custodian banks keep it a secret that:

– the white dealer voted by proxy, being empowered by his associate rromani man.

– white people capital is insignificant (5%)

– the vote of the white associate was not taken into consideration in the voting process

It is prohibited by the US law for the American corporate and US defense and weapons production industry corporation shares to be traded on the non-regulated OTC (over the counter) markets. Thus, the necessity to invent sophisticated financial products that are difficult to comprehend by the native white individuals. They have no economic significance either. These are not shares, but they can be turned into shares, by deceiving the vigilance of government anti-trust agencies. These financial products are futures contracts with options backed by loan bonds convertible into shares (convertible bonds) of US corporations. The conversion is done at the “trigger point”.

This “Trigger point” is that market value on the stock exchange of bonds issued by US corporations at which the interest rate plus the market value of the bond is less than the dividend plus the market value of the share.

At this “Trigger point” the investor converts his bonds into shares claiming that he is increasing the profit. The real reason for the conversion is the large influx of voting shares obtained by the Rromani dealer (which is under the command of Chinese financial engineers).

The market value of bonds and shares is skillfully manipulated on the major stock exchanges and driven towards the “Trigger point”. Thus, the white investor will prefer shares to bonds. Instead of the money he has invested in the corporation, he wants shares in that corporation. This is apparently also the intention of the rromani dealers which are under Chinese command (but without having idea who they work for).

Indian and Singaporean funds are not allowed to own shares in US armament companies, but they are allowed to own bonds convertible into shares issued by US industrial and armament companies.

D. Joint venture companies formed with the participation of B funds and C

The joint venture company formed will have its head office in Caribbean offshore and will have the following distribution of the capital participation:

– Caribbean-based closed mutual fund (type B) owned by a Rromani ethnic gay man – 95%.

– anonymous individual (type C) member of European Royal Families and French Freemasons (also gay) based in South Dakota with 5%. Before arrival in South Dakota the vote instruction are passing through Jersey Offshore.

It is worth mentioning that the two gay associates are sexual partners, linked also by a very powerful trust relationship.

The purpose of the Caribbean-based company is to collect the number of option contracts backed by convertible bonds, warrants, rights of US companies (banking and industrial).

In the voting scheme participate 72 closed Caribbean type B mutual funds and 72 anonymous type C funds from US South Dakota owned by wealthy white men.

One closed fund in group B creates a joint venture with one anonymous white man from category C (individual wealthy white man from South Dakota).

It results a total of 72 join ventures.

Using the 18 stock exchanges in the Caribbean (13 of which are offshore) and the 12 clearing banks attached to these exchanges (custodian banks which also keep the register of shareholders), the financial assets are taken from all the stock exchanges in the world and distributed as uniformly as possible to the 72 joint ventures.

These joint-venture enterprises must hold together around 37% of the voting rights.

Nobody imagine that these 72 joint ventures will vote, in an organized way, with the help of some secret messages and passwords, the same candidate for the position of CEO of the US company.

The rromani gipsy agent in D joint venture convinces his white associate to wait for a longer period, when the price of the asset will rise and he will have a higher material gain.

Then the white people wait and, indeed, after a period of 55 days the “trigger point” is reached and shares become more profitable than bonds.

As bonds are converted into shares there is a large inflow of votes.

The rromani people give a voting mandate to his white partner to vote for whomever he wishes (the votes will not be taken into account). This happens because the assets eligible to vote were bought after the record date. There will be taken into account the voting instructions given by the A closed fund which voted one minute earlier than the D joint-venture company.

This gives the voting instructions to the custodian bank in the DTCC South Dakota offshore network which makes the clearing on NASDAQ market and the custodian bank gives the voting instructions further to *Proxi Voting Service Provider “, This is an institution specialized only in the voting process.

In the “Electronic Voting System”, the software of the computer considers the voting instructions given by A company as valid. This is because the regulations of “Securities and Exchange Commission” ( SEC ) stipulate that if a company voted on the “Record Date” and then sold the shares, its voting instructions are still valid.

DTCC (Depository Trust and Clearing Corporation) is the largest network of clearing banks and depository banks (which keep track of companies shareholders, distribute dividends and execute voting instructions). It has offices in the USA – offshore South Dakota, UK, Singapore and others and operates clearing on the NASDAQ unregulated market.

E. Company E is an open-end investment fund of funds based in Delaware offshore to which the general public, individual investors and other open-end funds may subscribe. D type closed fund is one of the E open fund shareholders.

Among these open funds, with the complicity of the custodian bank, another 72 closed funds type D with rromani people majority shareholders are illegally hidden. This rromani people must not know the whole Chinese elections fraud operations.

F. These companies are the American corporations, banks or industrial corporations for which the elections should be fraud.

American Multinational Companies for which elections should be fraud

Election rigging represents the appointment of a Jewish director. The Jewish CEO has the incentive to ostentatiously show that Jews run big finance and big industry, which is completely false.

Behind these directors who are nothing but puppets, there are appointed other Oriental people (deputies) who fulfill the Chinese desire to rule the world.

1.Let’s assume that a certain Western multinational company has about 2700 shareholders.

2.Out of these, 500 are part of the secret Tibet-China Banking Trust – formed by 2500 joint venture funds analyzed above.

The 500 companies that are chosen to be part of the shareholding are always different, by rotation, from the group of 2500.

3. Out of the 500, only 72 funds form the voting majority. The 72 companies are always different, by rotation, from the group of 2500.

4. The remaining shareholders from point 1 are: 2700 – 500= 2200, which are funds open to the general public or to public persons. Anyone can buy shares in these funds. But these open to the public funds, even if they can gather in total 25%-30% of the votes, they do not vote, in an organized way, a certain candidate for a CEO position of the American Multinational Company in question.

The role of these 2200 open to the public funds of funds and individuals is very important because the 72 joint venture companies in which voting rights are concentrated in secret, are lost through them. So, the 72 C closed funds are covered by many other open funds.

Modus operandi for A, B: C, D, E funds:

The key role of the A companies is that they vote in secret, which means they allocate those voting rights that will (eventually) come from these convertible bonds they hold, on “record date“. The “record date” takes place about 60 days before the elections for the directorship of an American company.

What does voting mean? ie. allocating votes to a candidate or another, out of the total of 9 candidates. The voting rights will be taken in the future if necessary (within 60 days) from the contracts of options which have the potential of converting into voting shares.

We used the word “eventually” and “if necessary”, so the rromani people shareholder at A company voted with option contracts. He does not need to know that these assets will turn into shares, for sure.

Even if he is part of the secret plan, the rromani agent does not need to know the plan as a whole but only a small part of it.

It is important that the rromani dealer (A) who owns the closed-end fund A gives the voting instructions partially in blank. This means that one part is allocated to each candidate on a percentage basis and for the other part of the assets eligible for voting, he let the custodians and proxy voting service provider to vote instead of him. These are empowered through a Voting Trust Certificate.

It should also be noted that the shares that will result from the conversion do not have a single voting right but several voting rights (on average: 6) or are converted into several ordinary shares (aprox 6) with one vote each (privileged shares).

This is why the voting instructions are left as a percentage for each candidate because at that time he/she does not know the total number of votes resulting from the conversion. Remember that the voting instructions are given in the “Record Date” with approx. 60 days before the voting in the general assembly.

The secret voting instructions were received through an encrypted text, a polyalphabetical table and a password given by the Chinese agent.

The Clearing Bank in Singapore is part of the Depository Trust and Clearing Corporation (DTCC) network, set up and controlled by the Tibet-China secret banking trust.

The custodian bank (depository bank) in addition to Clearing (compensation) also keeps the register of shareholders, distributes dividends and carries on the voting instructions.

DTCC has subsidiaries also in South Dakota offshore, where the white American elites (white natives), keep their money, their shares, bonds and other financial assets. White man American elites are Freemasons and also part of the LGBT community.

Within a minute after giving voting instructions, A company will sell its financial assets to the closed-end fund B.

The key role in election rigging is played by the custodian banks in Singapore, secretly controlled by China. These banks participate, too, in election fraud, being protected by the stock exchange secrecy law and banking secrecy law that applies to the offshore companies.

The custodian banks servicing Singapore stock exchanges intentionally assigned voting instructions from closed fund A to closed fund B, based in the Caribbean. Fund B has as shareholder a rromani native, Chinese secret agent.

But the closed-end fund B forms a joint venture with the anonymous mutual fund C, owned by a white dealer (who keeps his wealth in South Dakota offshore).

This joint venture D has the following capital participation:

– closed-end company B, owned by rromani people – 95%

– anonymous white individual person C – 5%

Closed fund B participates with the financial assets ( purchased from fund A ) in the

joint venture formed with anonymous individual C.

So the joint venture D will be registered in the “Record Date”, in most cases, with the same assets with which fund A is registered. Then joint company D gives, also it, voting instructions.

“Record Date”, definition: the date that the issuing firm chose to:

- register the identity of companies holding, in that moment, shares and other financial assets eligible to vote (which can be converted into shares), in order to participate at the general meeting of shareholders.

- register the shares and other financial assets eligible for voting, held by these funds (companies).

Here is an example of “Record Date”: June 15th, 12.00 pm, Singapore based closed-end mutual Fund A, owned by rromani dealer number 1, gives the voting instructions at Record Date at 12:00 p.m. and, after a minute, sells the financial assets to the closed-end fund B, owned by rromani dealer number 2, based in the Caribbean. This happens for the reason not to find out that A closed fund originates from Asia.

Rromani dealer (fund B) takes possession of assets at one minute past 12.

But this fund is in a joint venture (D company) with a South Dakota-based C individual (member of European Royal Families).

D joint-venture also gives voting instructions at one minute past 12.

Voting instructions at one minute past 12 are given by the white dealer, who is empowered by his rromani associate to vote on behalf of the closed-end fund D.

It can be seen that although the white associate is a minority shareholder, he is the one that is visible when exercising the vote.

White Dealer is intentionally let by his rromani associate to give the voting instructions of joint venture D as he wishes, even though he is a minority.

The rromani dealer has been given special instructions (by Chinas agents) to let the white man to vote as he Wishes, because otherwise this would find out, in time, that he was forced to vote in a certain way.

Neither the rromani dealer nor his white associate know that the voting instructions will not be taken into account in the voting process, because they voted with the same financial assets with which the closed fund A voted with, and almost at the same time.

The first vote, of Fund A, at 12 o’clock, has priority over the second vote, of Fund D, at one minute past 12.

The second vote, that of the Fund D, takes place through the empowerment of Caribbean custodian banks. These are the custodian banks that service the Caribbean stock exchanges on which the financial assets eligible for voting have been purchased.

The empowerment was made by the white dealer, with the help of a Voting Trust Certificate. The stock exchanges through which the sale was made, from Singapore to the Caribbean Fund D, are called the East Caribbean Securities Exchange (ECSE – 8 stock exchanges).

US law stipulates that if a company has voted at the Record Date and then sold the eligible assets (which have the potential to turn into votes), its voting instructions remain valid at the general meeting (even if the meeting takes place 60 days later).

In conclusion, Joint Venture D closed-end fund vote instructions are not taken into account, because it bought the financial assets and voted after the Record Date.

These assets were already recorded by company A at Record Date 12:00.

But closed-end joint venture D is a shareholder in open-end fund E.

Private individuals and other open-ended funds, may subscribe to an open-end fund.

A closed-end fund is set up only by a few very wealthy people. It is not open to the general public, individuals and open-end funds to subscribe.

The closed-end funds are set up by the Tibetan banking trust and has anonym shareholders.

The fact that the votes of the white dealer are not taken into account in the voting process, in the general meeting, is kept strictly secret by the Proxy Voting Service Provider.

The Proxy Voting Service Provider is a custodian bank specialized solely in organizing the American voting process and is organized and run by the Tibetan- China secret agents.

The custodian banks in the Caribbean and South Dakota, DTCC, keep secret the fact that they have intentionally failed to point out that a closed-end D Fund was hidden among the shareholders of an open-end E Fund of Funds, located offshore Delaware.

This closed-end fund D (joint venture), basically uses the American individuals and other open-end funds of funds as a shield, to hide from US anti-monopoly governmental agencies.

The open Fund E takes the voting instructions from the joint venture Fund D and hands them over to the Proxy Voting Service Provider.

This last empowered intermediary secretly verifies whether a majority of votes has been created for the candidates indicated by China.

If the desired majority has not been achieved, they themselves fill in the sheet with instructions (left blank), on how to vote.

When a shareholder gives voting instructions in blank, it is understood that he allows the custodian bank or a Proxy Voting Service Provider to vote instead of him.

After the Proxy Voting Service Provider ensures that a majority of the votes goes to the candidate indicated by China, the centralized votes are transferred to the custodian banks serving New York Stock Exchange, Chicago, Mercantile Exchange and other US stock exchanges to vote at the general meeting of F corporation.

Summary:

l. Closed-end A fund in Singapore votes at Record Date and, after a minute, sells the basket of assets eligible to vote, to the closed-end B fund.

2. Caribbean-based closed-end B fund enters into a joint venture with the anonymous wealthy white man C from South Dakota, to form Caribbean D fund.

3. Caribbean-based joint venture fund D votes one minute after the fund A with the same assets.

Joint venture Fund D is disregarded because it purchased financial assets eligible to vote, after Record Date.

The Custodian Bank intentionally allocates by fraud the vote instructions of the closed Fund A to the closed Fund B. As a result, the A votes are allocated to the closed Fund D who is a joint-venture between B and C.

Conclusion: D closed fund is in the following situation: its own voting instructions were cancelled but he was assigned instead with A fund voting instructions (by fraud).

In other words, A fund voted with the hand of D joint venture fund. But D fund is represented by white man. Simply: Closed fund A voted with white man hand.

4. Joint venture closed-end Fund D is also a shareholder in an open investment fund of funds E based in the USA (Delaware).

Joint venture Fund D gives voting instructions to the open-end fund E through the white man shareholder. The white shareholder has been empowered to vote, through a voting trust certificate by his associate rromani shareholder (gipsy).

5. Open Fund of Funds E gives voting instructions to the New York Stock Exchange, empowering, with voting trust certificate, other custodian banks (where it holds the shares in custody) and the Proxy Voting Service Provider.

All the 72 funds participating in the voting scheme will have the same voting route:

72 Closed companies (funds) A

72 Closed companies (funds) B

72 Anonymous wealthy white man C from South Dakota

72 Joint ventures D

72 Open companies (funds of funds) E

1 – One American Corporation F that organizes the elections (by fraud)

For example, we presume:

The F Corporation has 2700 shareholders. 72 of them are E funds of funds.

- The rest of 2628 shareholders has a role to hide the 72 E open-end funds of funds.

- The 72 E type open-end funds of funds have the role to cover the 72 D type closed-end (joint-venture) funds.

One D closed fund is shareholder to one E open Funds of Funds. In total 72 D closed fund will be clandestine shareholder to 72 E open funds of funds.

- The 72 D closed funds (joint-venture) has the role to cover the 72 rromani (gipsy) majority shareholders. This way, the 72 white man minority shareholders (from D fund) are the ones that are visible.

The basket of assets eligible for voting have entered from Singapore in the Caribbean through the 8 exchanges of the East Caribbean Securities Exchange (ECSE).

Each of the 72 A closed funds sold their assets to the 72 B funds (whit approx. equal value of the assets), through the 8 ECSE stock exchanges.

At each of the 8 ECSE stock exchanges, assets are held in custody with 3 different custodian banks (out of the 12 custodian banks serving the Caribbean stock exchanges).

These custodian banks are part of the Depository Trust and Clearing Corporation DTCC network.

This way, the financial assets were sufficiently divided in very small amounts so as not to be identified by the other participants in the election fraud (especially the Indian stock brokers and the rromani dealers).

China wants the scheme to remain secret even from its accomplices (even more for the USA regulatory bodies).

Then the financial assets are sold from the Caribbean through 5 other offshore stock exchanges: Barbados, Bermuda, Bahamas, Curacao, Cayman. Further on through 5 stock exchanges that are not offshore: Bolsa de Valores Republica Dominicana, Latin America Exchange Rep. Dominicana, Trinidad de Tobago Stock Exchange, Jamaica Stock Exchange, Haiti Stock Exchange. In the Caribbean, there is a total of 18 stock exchanges.

From the stock exchanges that are not offshores (see the attached diagram), financial assets are further transferred on the NASDAQ market to Delaware, via the Canary Islands.

Clearing and custody are done through DTCC Deriv/Serv LLC.

On the New York Stock Exchange, if investigations were conducted, it would be found out that majority of the votes was organized by 72 white dealers through the 72 open-end funds.

These 72 open-end funds have been shuffled through another 2-3 thousand open-end funds that are shareholders in the F corporation (for which elections are organized).

Every joint-venture C type fund out of the 72 C closed funds can own 0.0879% shares in order to form a majority of about 38%.

72 x 6 votes x 0.0879% = 38%

72 – the number of joint-venture funds that are involved in the fraud elections

6 – six votes (average) per one privilegiate share (between 2 and 10)

Important:

a. In the USA, there is no system in place for confirming votes in the general assembly.

So white dealers do not receive confirmation that their votes have been taken into account by the Electronic Voting System

b. The rich white gay belonging to the European Royal Families and French Freemason people who hold their wealth in the DTCC custodian banks in South Dakota are not as rich as the media and business media claim. Even though it is claimed that the wealth of these white elites is 600 years old (we are discussing about the ages of royal dynasties), from the time when there were banks in England, the reality is that these elites do not own the American corporations but the Tibet-China Bank Trust.

In order to take a 5% stake in the joint venture in the Caribbean, with the rromani associate, white man invests using leverage loans facilitated by his associate in the ratio of 20 to 1.

Example: if he owns a wealth of 10 million USD loaning with a leverage of 20 to 1, he can invest in a company assets 20 times that amount, i.e. 200 million USD. After voting with these financial assets, he sells the assets and can return the leverage loan.

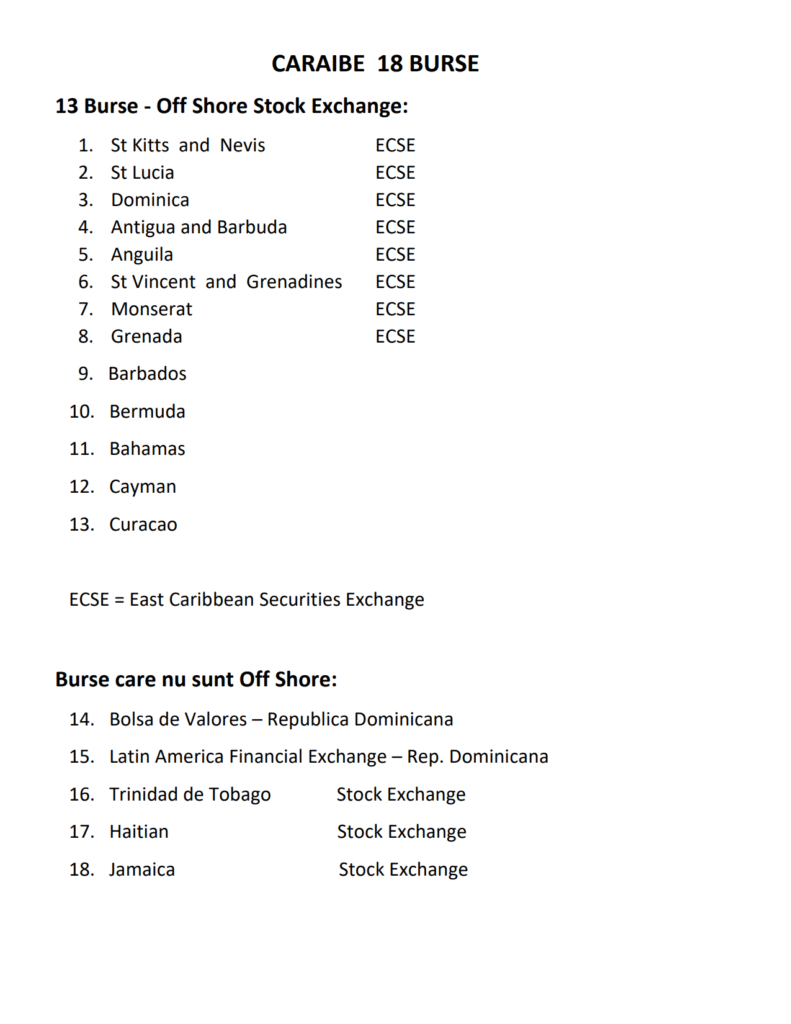

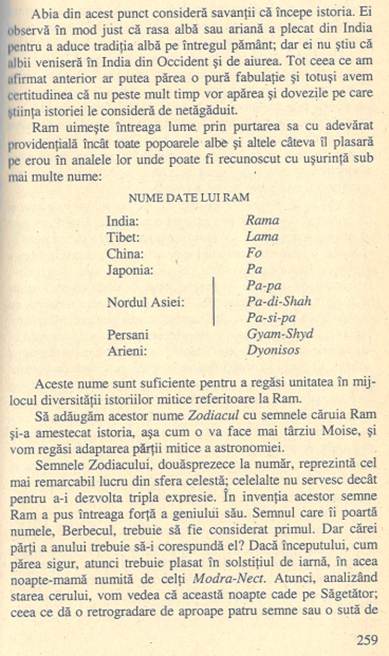

CARAIBE 18 BURSE

13 Burse – Off Shore Stock Exchange:

- St Kitts and Nevis ECSE

- St Lucia ECSE

- Dominica ECSE

- Antigua and Barbuda ECSE

- Anguila ECSE

- St Vincent and Grenadines ECSE

- Monserat ECSE

- Grenada ECSE

9. Barbados

10. Bermuda

11. Bahamas

12. Cayman

13. Curacao

ECSE = East Caribbean Securities Exchange

Burse care nu sunt Off Shore:

14. Bolsa de Valores – Republica Dominicana

15. Latin America Financial Exchange – Rep. Dominicana

16. Trinidad de Tobago Stock Exchange

17. Haitian Stock Exchange

18. Jamaica Stock Exchange

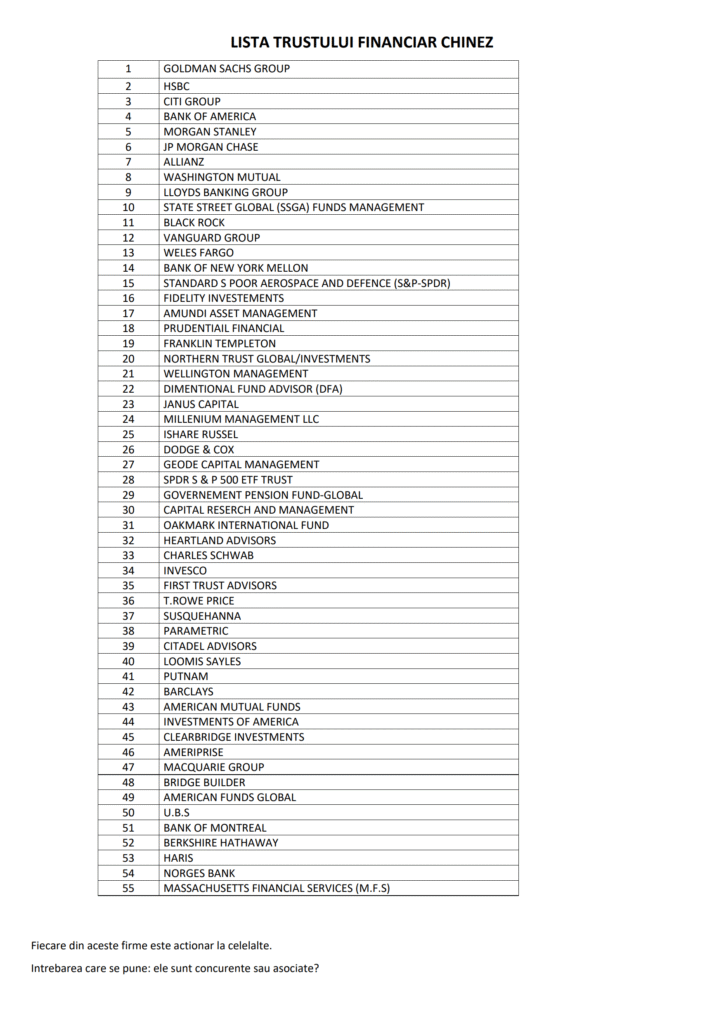

LISTA TRUSTULUI FINANCIAR CHINEZ

| 1 | GOLDMAN SACHS GROUP |

| 2 | HSBC |

| 3 | CITI GROUP |

| 4 | BANK OF AMERICA |

| 5 | MORGAN STANLEY |

| 6 | JP MORGAN CHASE |

| 7 | ALLIANZ |

| 8 | WASHINGTON MUTUAL |

| 9 | LLOYDS BANKING GROUP |

| 10 | STATE STREET GLOBAL (SSGA) FUNDS MANAGEMENT |

| 11 | BLACK ROCK |

| 12 | VANGUARD GROUP |

| 13 | WELES FARGO |

| 14 | BANK OF NEW YORK MELLON |

| 15 | STANDARD S POOR AEROSPACE AND DEFENCE (S&P-SPDR) |

| 16 | FIDELITY INVESTEMENTS |

| 17 | AMUNDI ASSET MANAGEMENT |

| 18 | PRUDENTIAIL FINANCIAL |

| 19 | FRANKLIN TEMPLETON |

| 20 | NORTHERN TRUST GLOBAL/INVESTMENTS |

| 21 | WELLINGTON MANAGEMENT |

| 22 | DIMENTIONAL FUND ADVISOR (DFA) |

| 23 | JANUS CAPITAL |

| 24 | MILLENIUM MANAGEMENT LLC |

| 25 | ISHARE RUSSEL |

| 26 | DODGE & COX |

| 27 | GEODE CAPITAL MANAGEMENT |

| 28 | SPDR S & P 500 ETF TRUST |

| 29 | GOVERNEMENT PENSION FUND-GLOBAL |

| 30 | CAPITAL RESERCH AND MANAGEMENT |

| 31 | OAKMARK INTERNATIONAL FUND |

| 32 | HEARTLAND ADVISORS |

| 33 | CHARLES SCHWAB |

| 34 | INVESCO |

| 35 | FIRST TRUST ADVISORS |

| 36 | T.ROWE PRICE |

| 37 | SUSQUEHANNA |

| 38 | PARAMETRIC |

| 39 | CITADEL ADVISORS |

| 40 | LOOMIS SAYLES |

| 41 | PUTNAM |

| 42 | BARCLAYS |

| 43 | AMERICAN MUTUAL FUNDS |

| 44 | INVESTMENTS OF AMERICA |

| 45 | CLEARBRIDGE INVESTMENTS |

| 46 | AMERIPRISE |

| 47 | MACQUARIE GROUP |

| 48 | BRIDGE BUILDER |

| 49 | AMERICAN FUNDS GLOBAL |

| 50 | U.B.S |

| 51 | BANK OF MONTREAL |

| 52 | BERKSHIRE HATHAWAY |

| 53 | HARIS |

| 54 | NORGES BANK |

| 55 | MASSACHUSETTS FINANCIAL SERVICES (M.F.S) |

Fiecare din aceste firme este actionar la celelalte.

Intrebarea care se pune: ele sunt concurente sau asociate?

Cum se organizeaza alegerile pentru consiliile de administratie ale tuturor corporatiilor multinatinoale ale lumii de catre

Tibet-China

Cum se construieste monopolul

- Instrumentele cu care se construieste majoritatea de vot

- Actiunile

Actiuni preferentiale: asigura o rentabilitate mai mare pe baza unui dividend prioritar care se plateste inaintea dividendelor actiunilor ordinare; dar nu are drept de vot.

Actiuni ordinare: nu au prioritate la profit, la dividend, dar au drept de vot.

Actiuni privilegiate: (voting right shares) – sunt emise cu privilegiul de a avea un vot, doua voturi sau mai multe voturi pentru o singura actiune.

Actiuni preferentiale participative: actiuni rascumparabile – la care emitentul poate pervedea o clauza de rascumparare daca considera ca rata dividentului va scadea in viitorul nu prea indepartat.

Actiuni cumulative: dividende se acumuleaza pentru o perioada de mai multi ani. Dividentul cuvenit se cumleaza in toti anii in care s-au inregistrat pierderi si se plateste cu prioritate in primul an in care se inregistreaza profit.

Actiuni convertibile: permite detinatorilor de actiuni preferentiale sa le converteasca in actiuni ordinare, (cu drept de vot). Convertibilitatea este exprimata de rata de conversie. In functie de cate actiuni ordinare pot fi obtinute pentru fiecare actiune preferentiala. Daca rata de conversie este 2 la 1, atunci fiecare actiune preferentiala poate fi convertia in 2 actiuni ordinare.

Actiuni de trezorerie: sunt actiuni proprii pe care societate si le rascumpara de pe piata din diverse motive. Cate vreme sunt in trezorerie, actiunile nu poarta dividente.

1

- Obligatiuni care se pot transforma in actiuni

Imprumuturi (sau datorii) care se pot converti in actiuni – obligatiuni de imprumut convertibile in actiuni. Detinatorul obligatiunii are dreptul sa primeasca actiuni la companie in locul banilor cu care a imprumutat compania.

Obligatiuni de imprumut cu bonuri de subscriere – aceste titluri de imprumut dau dreptul detinatorului sa achizitioneze ulterior la un pret fixat inaite actiuni la societatea emitenta.

Obligatiuni indexate: emitentul isi asuma obligatia de a actualiza valoarea acestor titluri in functie de un indice. (acesta poate fi si un indice bursier)

Drepturi de preferinta – intervine in cazul majorarii capitalului social prin emisiunea de noi actiuni. Actiunile nou emise vor fi oferite spre cumparare in primul rand acelor actionari care detin drepturile de preferinta.

Drepturi de atribuire – constau in participarea tuturor posesorilor de actiuni ordinare la majprarea capitalului social prin incorporarea de reserve. Practic, majorarea de capital social genereaza o distribuire gratuita de actiuni. In plus, se poate distribui dividendul sub forma de actiuni. Drepturile de atribuire se pot vinde pe piata.

Warantul – este o valoare mobiliara care indreptateste pe detinator sa cumpere actiuni la societatea care i-a emis la un pret fixat prin warrant. Pe piata apar ca:

– actiuni cu warrant;

– obligatiuni de imprumut cu warrant.

Toate aceste obligatiuni de imprumut permit ca banii imprumutati unei societati sa se transforme in actiuni cu drept de vot la acea societate. Aceste Obligatiuni si Drepturi care se convertesc in actiuni se vand pe bursa. Astfel ele pot fi cumparate de actionarii unei companii inaintea Adunarii generale a actionarilor pentru a avea un aflux mare de actiuni cu drept de vot.

Asa se construieste o majoritate de voturi pentru a numi in functie pe directorul companiei.

Aceste tipuri de actiuni si obligatiuni convertibile in actiuni au fost inventate si legiferate de “Secta Bancara Tibetana” condusa de Dalai Lama pentru a stapani prin majoritate de actiuni (voturi) toate companiile si corporatiile multinationale inregistrate in Occident.

Atentie!! – aceste companii sunt doar inregistrate pe teritoriul American si European dar proprietarii, stapanii lor sunt in Tibet – China.

Am vazut cateva din instrumentele cu care se construieste majoritatea de vot. Acum sa vedem cum se voteaza, pentru ca nu pot sa intre 100 de chinezi in sala de vot:

Astfel, un cetatean chinez da mandate de vot catre un agent sectret rrom din Punjeabul indian sa voteze in lipsa lui. Acest agent sectret se prezinta ca reprezentant al firmei care detine actiunile. Aceasta firma face parte din Trustul Bancar Tibetan. La randul lui el mandateaza o institutie care sa il reprezinte in Adunarea Generala a Actionarilor – o societate inchisa (closed corporation) din Gurgaon, Hyderabad, Pune, Kolkata etc din India, Singapore.

Aceasta companie, la randul ei mandateaza o alta institutie – Banca Custode si este tocmai acea banca care are ca obiectiv sa tina in pastrare actiunile companiilor cotate la bursa, prin urmare si ale firmei lui.

Banca Custode, care se afla in Singapore, are acces si vizibilitate totala la actiunile si obligatiunile care se pot converti in actiuni aflate in posesia tuturor companiilor care fac tranzactii la acea bursa. Tot ea este atasata la o bursa de valori si tine in evidenta actiunile si obligatiunile si cosurile de contracte futures care au suport actiuni (care se pot transforma in actiuni) aflate in posesia celor care cumpara sau vand pe acea bursa.

Exemplu

Sa presupunem ca pe bursa din Saint Lucia Securities Exchange din Caraibbe s-au cumparat cosuri de active care se pot schimba in actiuni la firma Boeing de catre un cumparator – fond mutual al lui JP Morgan de la un vanzator din Singapore. Atunci cosurile (pachete) de active financiare care se pot transforma in actiuni Boeing sunt transferate de la banca custode din Singapore care deserveste bursa din Singapore, catre banca custode din Saint Lucia din Caraibbe.

Sa presupunem ca si alte cosuri de contracte de optiuni care se pot transforma in actiuni ale firmei Boeing au fost cumparate de o firma – de exemplu Vanguard, de pe bursa din Grenada (Grenada Securities Exchange), tot din Caraibbe, de la un dealer aflat in Singapore. Si in acest caz, cosul de contracte futures cu optuiuni din banca custode din Singapore, atasata la bursa din Singapore sunt transferate in custodie in banca custode din Grenada (din Caraibbe) atasata la bursa din Grenada numita Eastern Caribbean Securities Exchange (ECSE).

In continuare, consideram ca alte cosuri de strategii de optiuni bazate pe obligatiuni convertibile in actiuni ale firmei Boeing au fost cumparate de un dealer spre exemplu Black Rock, pe bursa din Dominica numita Dominica Eastern Caribbean Securities Exchange de la un dealer, sa presupunem Goldman Sachs tot din Singapore.

Atunci aceste pachete de strategii cu optiuni bazate pe obligatiuni convertibile in actiuni, pe warante si pe “drepturi de atribuire” ale unor actiuni noi emise, ale firmei Boeing sunt transferate de la banca custode din Singapore care deserveste Singapore Stock Exchange catre banca custode din Dominica atasata la bursa din Dominica.

In realitate, aceste pachete de produse finaciare sunt confectionate in India si trec prin Singapore, apoi prin bursele din Caraibbe (18 burse) care reprezinta veriga de legatura intre Orient = India si Occident = SUA, Europa, Canada. Ulterior, pachetele de obligatiuni convertibile in actiuni Boeing trec in posesia celor 8 Banci Custode din cadrul Eastern Caribbean Securities Exchange (ECSE), repartizate cat mai uniform, acestea asteapta termenul pentru ca toate instrumentele derivate de pe piata OTC care au ca suport obligatiuni convertibile in actiuni ale companiei Boeing sa se converteasca in actiuni la Compania Boeing.

La contractele futures si futures cu optiuni care au ca suport obligatiuni convertibile in actiuni, warante, “drepturi” emise de Boeing – mentionate la inceput, exista un punct mort (trigger point) la care nu mai aduc profitul scontat si sub acest pretext artificial ele se convertesc in actiuni la firma Boeing.

Dealerii/vanzatori si dealerii/cumparatori de la Bursele din India fac intentionat ordine de cumparare si vanzare care conduc intentionat produsele financiare catre acea valoare de “piata” numita punct de declansare – trigger point (sau punct mort). La aceasta manevra foarte subtila participa si brokerul bursei care in intelegere cu dealerii conduc un cos mare de active financiare in punctul mort – trigger point, la care acestea se schimba in actiuni (cand profitul din dividendul actiunii devine mai atragator decat profitul din dobanda obligatiunii).

Mentionam ca la momentul la care se declanseaza conventirea in actiuni, acele produse financiare nu se mai afla in Bancile custode din India si Singapore si in Bursele din Offshor-rurile din Caraibbe, ci se aflau deja in Bursele electronice din Canare si in offshore-rurile din Delaware si South Dakota, si mai departe in New York Stock Exchange, New York NASDAQ, Chicago Mercantille Exchange

Aceste burse din offshore-rurile din Caraibbe sunt:

– Montserat

– Anguila

– Saint Lucia

– Grenada

– Dominica

– Saint Kitts and Nevis

– Saint Vincent and Grenadines

– Antigua and Barbuda

Si formeaza grupul celor 8 Eastern Caribbean Securities Exchange (ECSE).

Atentie!! – obligatiunile convertibile in actiuni se afla in pastrare la Banca Custode care deserveste bursa unde ele au fost cumparate ultima data.

Dupa aceata faza arhitectii financiari din China/Tibet pregatesc pachete de active (cosuri de active financiare) ce urmeaza sa se preschimbe in actiuni si pregatesc si cele 72 (100) de companii din cele 2500 (care formeaza Trustul Bancar Tibetan) care sunt cele mai potrivite pentru a intra in posesia acestor active (pentru a le folosi la vot).

Atentie!!- Cele 72 de companii care acumuleaza actiunile pentru votare se aleg prin rotatie dintre cele 2500 de companii financiare, care formeaza Trustul Secret Chinez.

Aceste 72 de companii financiare vor fii mereu altele care numesc conducerea la fiecare Corporatie Industriala Multinationala din indicii : S&P 500 si din Dow Jones.

Aceste 72 de companii, toate cu procente de sub 1% vor avea o putere de vot (votting power) de 37% – 40%, suficienta pentru a numi conducerea firmei.

Pentru a strange actiuni se confectioneaza blocuri sau cosuri cu active care se pot converti in actiuni.

Aceste cosuri contin:

– obligatiuni convertibile in actiuni;

– obligatiuni cu warante convertibile in actiuni;

– obligatiuni de imprumut cu bonuri de subscriere (care permit sa subscri la actiuni noi emise);

China a ales bursele Indiei sa fie in varful lantului de burse fuzionate intre ele (din Europa, SUA si Canada).

Bursa NASDAQ este o bursa a burselor din lume si din cauza ca se afla in varful piramidei de burse fuzionate intre ele are posibilitatea sa vada toate tipurile de actiuni si obligatiuni, cine este proprietarul lor, sa faca pachetul de active si sa le aduca in punctul de declansare – punctul mort (trigger point). La acest punct de declansare pachetele de active se transforma in actiuni.

La fel si DTCC – Depositary Trust and Clearing Corporation care este cel mai mare conglomerat de banci custode interconectate intre ele si are dreptul si posibilitatea de a vedea toate actiunile si obligatiunile, cine le detine si cum sa formeze cosul de active care se pot transforma in actiuni. Aceste active OTC bazate pe obligatiuni convertibile in actiuni sunt cumparate de pe bursele din Caraibbe, ajung in Bancile custode din Caraibbe. Apoi se vand cate o portiune catre:

1. bursa din Trinidad de Tobago.

2. bursa – Latin America International Financial Exchange din Republica Domnicana.

3. Bolsa de Valores de la Republica Dominicana.

4. Haiti Stock Exchange.

5. Jamaica Stock Exchange.

Si, in final, ajung la Banca Custode a acestor burse.

Este foarte important de precizat ca acestea cinci burse nu sunt offshore-uri si nu trezesc suspiciuni.

Dupa care se vand catre bursele din Insulele Canare care au independenta fata de guvernul de la Madrid (se vehiculeaza ideea ca nu sunt offshore-uri dar in realitate functioneaza ca offshore-uri pe piata NASDAQ ).

De aici obligatiunile convertibile in actiuni pleaca (prin intermediul tranzactiilor care au loc intre mai multe fonduri mutuale – societati mixte) prin imputernicirea unui agent, catre offshore-rurile americane:

1 – Delaware – un gigant finaciar, unde isi au sediul mii de fonduri mutuale;

2 – South Dacota – o bursa mascata de produse OTC. Vanzarile se fac prin Electronic Comunication Network pe piata NASDAQ.

La aceste burse, Banca Custode (Proxy Voting Service Provider) este insarcinata sa execute procesul de votare si creeaza majoritatea de voturi pentru a numi consiliul de administratie si directorul (CEO).

II. Metode pentru a obtine majoritatea de voturi

Pentru a pregati o majoritate de voturi in posesia companiilor financiare care formeaza Trustul Bancar Tibetan, expertii lor finaciari se folosesc de mai multe procedee.

Sa presupunem ca numarul companiilor mama din Trustul Bancar Tibetan este de aproximativ 55. Fiecare companie are aproximativ 45 “pui” – subsidiare – alte companii din acelasi grup care poarta numele companiei mama: banca comerciala; banca de investitii; fonduri mutuale; hedge fonduri (fonduri cu capital de risc); broker dealeri (adica burse); firme de asigurari; asset manager – adica banca custode sau clearing bank; societate inchisa (closed corporation). In total 55×45=2500 companii (aprox.).

Din aceste companii arhitectii financiari din China trebuie sa aleaga 72 de companii care sa intruneasca o majoritate de 37-40% din drepturile de vot ale firmei pentru a vota in adunarea generala a actionarilor si a alege un director. Directorul trebuie sa fie de origine evreiasca pentru a arata ostentativ ca evreii conduc toate companiile si finantele lumii(ceea ce este complet fals).

Trebuie mentionat ca 10-20% din actiunile emise nu au drept de vot.

De asemenea, companiile care au participatii mari de 2% – 3% din actiuni nu au drept de vot pentru ca legile finaciare internationale nu permit acest lucru. Aceasta pentru ca obiectul lor de activitate este chiar detinerea de actiuni la alte companii in scopul tranzactionarii. Astfel se presupune ca ar fi tentati sa faca monopol pe piata.

Aceasta doar de fatada pentru ca agentiile guvernamentale sa-si focuseze vigilenta pe actionarii mari.

In timp ce agentiile antimonopol din occident supravegheaza actionarii de top, chinezii formeaza, in ascuns, o majoritate de voturi cu actionari multi dar cu procente mici care detin sub 1% din voturi. Acestia nu atrag atentia dar voteaza organizat acelasi candidat la functia de director – CEO pe baza unui cod secret.

72 actionari x 0,51% = 37%

Deci, cu un procent mediu de 0.51% se poate obtine 37% daca toti cei 72 voteaza aceeasi membri in consiliul de administratie. Aceasta presupunand ca din 100% actiuni doar 80% au drept de vot. Astfel cele 2500 de companii, cumparand actiuni unii la altii, si intrunind majoritate de voturi unii la altii, practic au fuzionat.

Legal, fuziunea traditionala a doua companii se petrece cu totul altfel, este foarte vizibila, dezbatuta in massmedia si este anuntata public. Doua companii pot fuziona prin schimb de actiuni sau prin emisiunea de actiuni noi la noua firma rezultata prin fuziune, astfel incat valoarea actiunilor unui actionar sa fie echivalenta cu valoarea actiunilor acelui actionar inainte de fuziune.

In cazul trustului de 2500 de companii financiare Tibetane fuzionarea lor nu este sesizata public pentru ca ele au fuzionat in secret pe bursa. Ele au fost de acord tacit sa cumpere actiuni unele la altele, sa voteze unele la altele si sa numeasca consiliul de administratie unele la altele. Acum ele formeaza o singura companie, adica un conglomerate format prin fuziunea nevizibila a 2500 de firme financiare. Dupa ce s-a infiintat monopolul de 2500 de firme financiare, acesta voteaza la firmele industriale americane prin rotatie. Aceasta fuziune nu este observata de societatea democratica occidentala sau de agentiile guvernamentale antimonopol. Nimeni nu isi imagineaza mecanismul prin care 2500 de companii ar putea sa fie intelese intre ele pentru a vota acelasi canditat la functia de CEO (director).

Fuzionarea aceasta ilegala este condusa din Tibet din vechime, foarte precis, pe baza unor parole si a unor tabele de cifrare numite cifruri polialfabetice. Tabelele sunt foarte bine explicate in Kabala – Magia Ceremoniala (pag 109).

Parolele se transmit direct din CHINA TOWN, din orasele americane unde sunt bursele, prin intermediul unor agenti de etnie roma catre indienii care controleaza bursele si catre iranienii care controleaza Bancile Custode.

Nici iranienii si nici indienii nu stiu ca cifrurile vin din Tibet prin China Town raspandite in tot occidentul. Mai mult, nici guvernele iranian si indian nu cunosc faptul ca participa in activitatea unei secte bancare Chineze.

Doar un grup mic de 500 – 1000 de iranieni condusi de Ayatolah si un grup de 500 – 1000 de indieni condusi de liderii religiosi hindusi (din zona Taj Mahal) si brahmani sunt implicati in aceasta activitatea bancara oculta.

Inputernicirea de vot transmisa in secret contine:

a) numele companiei finaciare care detine actiunile, numarul de actiuni detinute si numarul de voturi corespunzatoare pe care are dreptul sa si le exprime in adunarea generala a actionarilor,

b) numarul de voturi acordat fiecarei din cele 9 persoane candidate din care 5 vor fi alesi in consiliul de administratie.

Apoi cei 5 alesi il vor alege cu majoritatea de voturi pe managerul companiei.

Agentul imputernicit sa transmita parolele si numele canditatului caruia sa ii aloce voturile este protejat de legea anonimitatii si legea secretului bancar. El face parte dintr-o societate financiara inchisa- care nu este deschisa publicului (closed corporation) si care se afla in offshore.

Schema de Vot – Companiile

Exista sase tipuri de firme care intra in joc:

- Fonduri mutuale inchise orientale cu sediul in Singapore (dar organizate din India) detinute de dealeri rromiaflati sub comanda Chinei.

- Fonduri mutuale inchise cu sediul in Caraibe detinute de alti dealeri rromi(agenti chinezi).

- Fonduri anonime detinute de dealeri albi, masoni cu sediul in South Dakota SUA – Offshore.

- Societati mixte ( joint venture ) inchise, formate cu participarea fondurilor B si C.

- Companie (fond) deschisa, americana cu sediul in Delaware SUA, aceasta este un fond deschis detinut de publicul larg, persoane fizice si de alte fonduri deschise.

- Companie americana la care se organizeaza alegerile (se trucheaza alegerile), banci, corporatii industriale.

In continuare se detaliaza fiecare tip de firma in parte.

- Fondurile mutuale inchise ( closed corporation ) din Singapore fac parte din Trustul Bancar Tibetan secret.

La aceste fonduri inchise nu poate detine actiuni publicul larg , deci nu sunt deschise pentru subscriptie publica , actionari lor sunt cetateni rromi sunt protejati de legea anonimitatii si se afla sub comanda Tibet-China.

Ei nu sunt proprietarii reali ai capitalului de lucru. Acest capital este detinut de agentii chinezi care isi au companiile ( alte fonduri inchise ) in offshor-uri din India , Chennai , Pune , Bangalore , Kolkata , Gurgaon , Vishakhapatnam , Hyderabad , New Delhi.

Aceste fonduri inchise au rolul sa stranga de pe piata OTC produse derivate – contracte de optiuni care au ca suport obligatiuni de imprumut convertibile in actiuni la corporatiile americane ( banci si industrie ).

In afara de obligatiuni convertibile ( covertible bonds ) mai exista si alte active financiare care formeaza suport pentru contractele de optiuni :

-warante

-drepturi de atribuire ale unor actiuni

-drepturi de subscriere a unor noi actiuni

care se pot converti in actiuni la firmele americane la care se vor organiza alegeri pentru numirea CEO.

B . Fondurile mutuale inchise cu sediul in Caraibe

Acestea se prezinta ca subsidiare ( filiale ) ale unor firme financiare americane doar pentru a deruta agentiile antimonopol occidentale cu numele lor.

In total fondurile inchise ( closed corporation ) sunt in numar de aproximativ 2500 si au sediile in India , Mauritius , Singapore , Caraibe . Desi au natoinalitatea tarii unde au sediul adica indiana, singaporeza , caraibiana ele au denumiri americane : JP Morgan , Goldman Sachs , Allianz , Morgan Stanley , State Street Global , Washington Mutual , Blackrock , Vanguard , Fidelity , Citigroup , Wells Fargo , etc.

Bancile mama care fac parte din Trustul Bancar Tibet – China sunt in numar de aprox. 55 ( vezi tabelul cu Trustul Bancat Tibet –China ) si au sediul in SUA deci au nationalitate americana. Dar asa zisele filiale ale lor , fonduri mutuale inchise din Orient si Caraibe sunt aproximativ 45 pentru fiecare firma mama.

In total 55 x 45 = 2500 aprox. filiale Orientale si Caraibe cum am precizat anterior Aceste filiale Orientale si din Caraibe ajung sa formeze majoritatea de vot si la firmele mama din SUA prin schema descrisa acum:

Aceste 2500 de firme inchise ( closed corporation ) sunt actionare unele la celelalte si voteaza conducerea unele la celelalte formand un MONOPOL.

Fondurile mutuale din caraibe au rolul de a forma societati mixte ( joint venture ) cu fondurile de tip C , detinute de cetateni americani albi gay masoni din South Dakota. Averea albilor din South Dakota offshore este administrata de bancile custode din South Dakota. Practic vor folosi cetatenii americani albi ca paravan pentru a truca procesul de votare lasand sa se inteleaga pentru publicul american si elitele politice ca albii voteaza.

C . Fondurile anonime detinute de dealeri albi gay masoni cu sediul in South Dakota offshore SUA au rolul de a masca aportul de capital majoritar al asociatului sau rrom (care detine fondul inchis B ) cu care s-a asociat intr-o societate mixta.Totodata dealerul alb mascheaza si votul dat la “Record date “ de firma de tip A din Singapore. Aceasta pentru ca publicul american si elitele conducatoare trebuie sa creada (in mod eronat) ca instructiunile de vot au fost date de dealerul alb si ca ele au fost luate in considerare.

Bancile custode tin secret faptul ca:

– dealerul alb a votat prin mandat de vot fiind imputernicit de asociatul sau rrom

– capitalul albului este nesemnificativ ( 5% )

– votul asociatului alb nu a fost luat in calcul la votare

Legea americana interzice ca actiunile de la corporatiile americane (si de armament) sa fie tranzactionate pe piata Over The Counter ( OTC ) nereglementata. Astfel a aparut necesitatea inventarii unor produse financiare sofisticate greu de inteles pentru nativii albi dar care nu au nici o semnificatie economica. Acestea nu sunt actiuni dar se pot transforma in actiuni inseland vigilenta agentiilor guvernamentale antimonopol americane. Aceste produse financiare sunt contracte futures cu optiuni avand ca suport obligatiuni (de imprumut) convertibile in actiuni ale corporatiilor americane. Convertirea apare la “Trigger point “ numit si punct de declansare sau punct mort.

Acest “Trigger point “ este acea valoare de piata la bursa a obligatiunilor emise de corporatiile americane la care dobanda plus valoarea de piata a obligatiunii este mai mica decat dividendul plus valoarea de piata a actiunii.

In acest punct “Trigger point “ investitorul isi converteste obigatiunile in actiuni pretinzand ca se mareste profitul. Motivul real al convertirii este afluxul mare de actiuni cu drept de vot obtinut de dealerul rrom (care este sub comanda ingineriilor financiari chinezi).

Valoarea de piata a obligatiunilor si actiunilor este manipulata cu abilitate pe marile burse si conduse catre “ Trigger point “ astfel investitorul alb va prefera actiunile si nu obligatiunile. Adica in locul banilor pe care i-a imprumutat corporatiei doreste actiuni la aceasta corporatie. Acest lucru aparent il urmaresc si dealerii rromi aflati in slujba chinezilor (dar fara sa stie pentru cine lucreaza).

Fondurile orientale nu au voie sa detina actiuni la firmele de armament americane dar au voie sa detina obligatiuni convertibile in actiuni emise de firmele industriale americane si de armament.

D. Societati mixte ( joint venture ) formate cu participarea fondurilor B si C

Societatea mixta formata va avea sediul in Caraibe offshore si va avea urmatoarea distributie a capitalului cu care participa fiecare :

-fond mutual inchis cu sediul in Caraibe ( tip B ) detinuta de un etnic rrom gay – 95%

-fond anonim ( tip C ) detinut de dealeri albi masoni anglosaxoni gay

cu sediul in South Dakota – 5%

De mentionat ca cei doi gay asociati sunt parteneri sexuali intre care s-a stabilit o relatie de mare incredere.

Societatea mixta cu sediul in Caraibe are rolul de a aduna numarul de contracte de optiuni care au ca suport obligatiunile convertibile ale firmelor americane ( bancare si industriale ).

In schema de vot intra 72 de fonduri mutuale inchise din Caraibe de tip B si 72 de fonduri mutuale anonime de tip C din SUA South Dakota offshore.

Un fond inchis din grupul B creeaza o societate mixta cu un fond anonim din categoria C.

In total 72 societati mixte.

Prin intermediul celor 18 burse din Caraibe ( din care 13 sunt in offshore ) si cele 12 banci de clearing ( banci custode care tin si registrul actionarilor ) activele financiare se preiau din toate bursele lumii si se distribuie cat mai uniform catre cele 72 de societati mixte .

Aceste societati mixte trebuie sa detina impreuna aproximativ 37% din drepturile de vot.

Nimeni nu s-a gandit ca aceste 72 de societati mixte vor vota organizat cu ajutorul unor mesaje secrete si a unor parole , acelasi candidat la functia de CEO al firmei americane.

Agentul rrom din firma mixta D il convinge pe asociatul lui alb sa astepte o perioada mai lunga , cand pretul activelor vor creste si va avea un castig material mai mare.

Atunci albul asteapta si intr-adevar dupa o perioada se ajunge la “trigger point” si actiunile devin mai rentabile decat obligatiunile.

Deoarece obligatiunile se convertesc in actiuni apare un aflux mare de voturi.

Cetateanul rrom da un mandat de vot catre partenerul sau alb sa voteze cu cine doreste ( voturile nu vor fi luate in calcul ). Vor fii luate in calcul instructiinile de vot date de firma A care a votat cu un minut mai devreme decat firma mixta D.

Acesta da instructiunile de vot catre banca custode din reteaua DTCC South Dakota offshore care face clearingul pe piata NASDAQ si banca custode da instructiunile de vot mai departe catre “Proxi Voting Service Provider “.Aceasta este o institutie specializata doar in procesul de votare la companii.

La “Electronic Voting System” softul calculatorului considera valabile instructiunile de vot date de firma A. Aceasta pentru ca regulamentul “Security and Exchange Comision “ ( SEC ) stipuleaza ca daca o firma a votat la “Record Date” si dupa aceea a vandut actiunile, tot ei ii raman valabile instructiunile de vot.

DTCC ( Depository Thrust and Clearing Corporation) este cea mai mare retea de banci de clearing si banci depozitare ( care tin evidenta actionarilor la companii ,distribuie dividendele si executa instructiunile de votare ).Are reprezentante in SUA – South Dakota offshore , Anglia , Singapore si opereaza clearing pe piata nereglementata NASDAQ.

E. Compania E este un fond deschis de investii cu sediul in Delaware offshore la care poate sa subscrie publicul larg, persoane fizice dar si alte fonduri deschise.

Printre aceste fonduri deschise se ascunde cu complicitatea bancii custode si fondul inchis D, care are actionar majoritar asociatul rrom. Acest asociat rrom nu trebuie sa fie la vedere

F. Aceste companii sunt corporatiile americane, banci sau corporatii industriale la care trebuiesc organizate (trucate) alegerile

Companiile Americane Multinationale la care trebuiesc organizate ( trucate ) alegerile. Trucarea alegeriilor constra in numirea unui director evreu. CEO-ul evreu are rolul de a arata la vedere ostentativ ca evreii conduc marea finanta si marea industrie, cee ce este complet fals. In spatele acestor directori care sunt niste marionete sunt numite alte persoane orientale (adjuncti) care indeplinesc dezideratul chinez de a conduce lumea.

1. Sa presupunem ca o firma oarecare multinationala occidentala are aproximativ 2700 de actionari.

2. Din acestea 500 fac parte din trustul bancar secret Tibet – China care numara cele 2500 de fonduri societati mixte, analizate anterior.

Cele 500 de firme alese sa faca parte din actionariat sunt mereu altele prin rotatie din cele 2500.

3. Din cele 500 doar 72 de fonduri formeaza majoritatea de vot. Cele 72 de firme sunt mereu altele prin rotatie din cele 2500.

4. Restul actionarilor de la punctul 1 sunt : 2700 – 500 = 2200 sunt fonduri deschise publicului larg sau persoane publice. Oricine poate cumpara actiuni la aceste fonduri. Dar aceste fonduri deschise publicului chiar daca pot intruni in total 25%-30% din voturi ele nu voteaza organizat un anumit candidat in functia de conducere a Companiei Multinationale Americane in cauza.

Rolul acestor 2200 de fonduri deschise publicului sau persoane fizice este foarte important intrucat cele 72 de societati mixte in care sunt concentrate in secret drepturile de vot, se pierd printre ele.

Modul de operare al fondurilor A, B, C, D, E:

Rolul cheie al companiilor A este ca voteaza in secret, adica aloca acele drepturi de vot care vor provenii ( eventual ) din aceste obligatiuni covertibile detinute de ele , la “ record date “. “Record date “ are loc la aproximativ 60 de zile inaintea algerilor pentru functia de director a unei companii americane.

Ce inseama a vota ? : adica a aloca voturile catre un candidat sau altul la functia de conducere din totalul de 9 candidati . Drepturile de vot vor proveni in viitor daca va fi cazul ( in cele 60 de zile ) din contractele de optiuni care au potentialul de a se converti in actiuni cu drept de vot.

Am folosit cuvantul “eventual” si daca va fii cazul pentru ca dealerul rrom actionar la compania A a votat cu niste contracte de optiuni. El nu trebuie sa cunoasca faptul ca aceste active se transforma sigur in actiuni.

Chiar daca face parte din planul secret agentul rrom nu trebuie sa cunoasca planul in ansamblu ci doar o mica parte din el.